Best Passive Income Investments USA – Complete Guide

Welcome to Maintain Market; we post finance, investment, insurance, and loan blogs. In this blog, we will talk about the best passive income investments USA.

📌 What Is Passive Income?

Passive income is money earned with minimal daily effort after the initial setup. Unlike a job, where income stops if you stop working, passive investments continue generating cash flow.

Passive income in the USA usually comes from:

- Investments

- Assets

- Businesses that run without your active involvement

The goal is financial freedom, cash flow stability, and wealth building.

🧠 Why Passive Income Is Important in 2026

With rising living costs, inflation, and economic uncertainty, relying on one income source is risky. Passive income helps by:

✔ Creating multiple income streams

✔ Reducing financial stress

✔ Supporting early retirement

✔ Funding lifestyle goals

🏆 BEST PASSIVE INCOME INVESTMENTS USA

We’ll rank them based on:

- Risk level

- Investment required

- Returns

- Effort

1️⃣ Dividend Stocks

How it works:

You buy shares of companies that distribute profits to shareholders regularly.

Potential returns:

- Dividend yield: 2%–6%

- Capital appreciation possible

Best for:

Long-term investors

Examples:

- Coca-Cola

- Johnson & Johnson

- Procter & Gamble

2️⃣ Dividend ETFs

Instead of one stock, ETFs hold many dividend-paying stocks.

✔ Diversification

✔ Lower risk

✔ Easy to manage

Popular ETFs:

- VYM

- SCHD

- HDV

3️⃣ Real Estate Investment Trusts (REITs)

REITs invest in properties and pay out rental income.

✔ No property management

✔ Regular payouts

✔ Stock-like liquidity

Types:

- Residential REITs

- Commercial REITs

- Data center REITs

4️⃣ Rental Real Estate

Buying property and renting it out.

✔ High cash flow potential

❌ Requires management

Can be outsourced to property managers.

5️⃣ High-Yield Savings Accounts

Low risk, FDIC insured.

Returns: 3%–5%

Great for emergency funds.

6️⃣ Certificates of Deposit (CDs)

Fixed-term deposits.

Safe but less flexible.

7️⃣ Bonds & Bond Funds

Government and corporate bonds.

Stable income, lower risk.

8️⃣ Peer-to-Peer Lending

Lend money to borrowers online.

Higher risk, higher returns.

9️⃣ Index Funds

Track markets like S&P 500.

Long-term growth with dividends.

🔟 Online Businesses

Examples:

- Blogging

- YouTube

- Digital products

High effort initially, passive later.

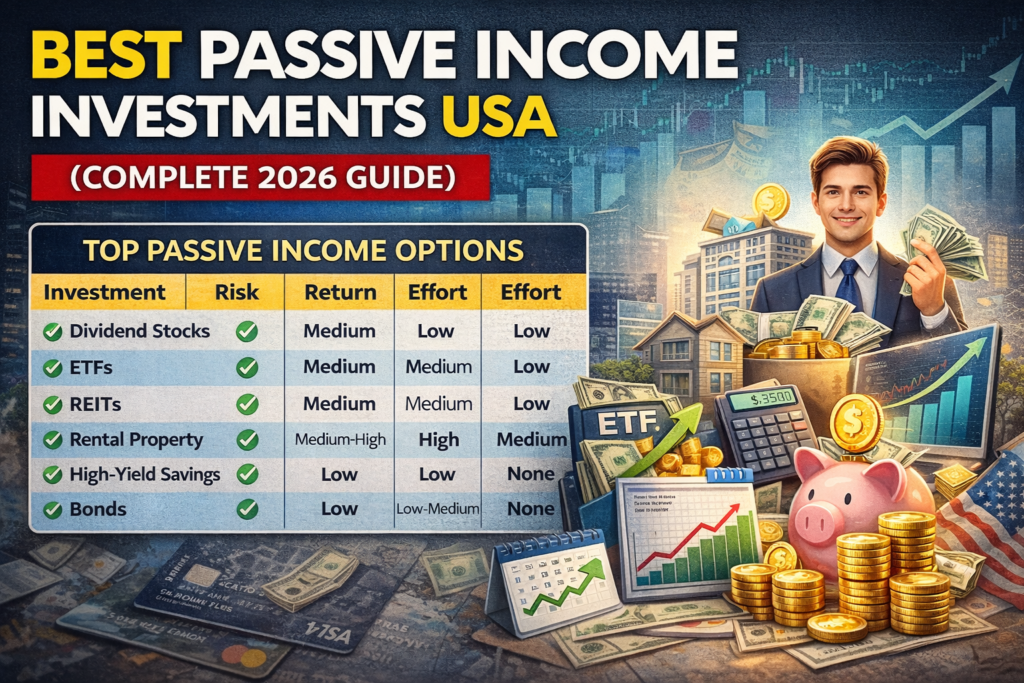

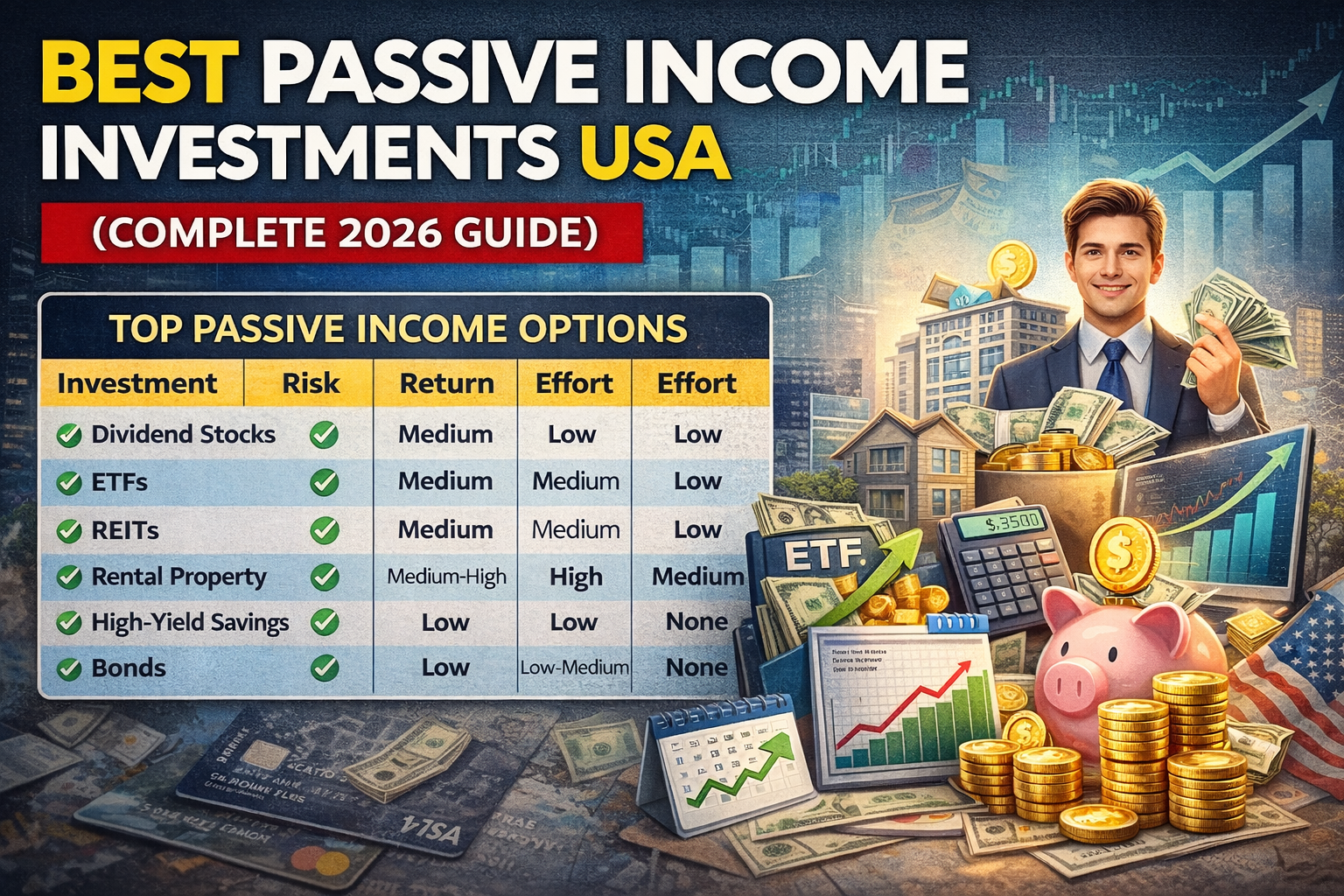

📊 Comparison Table

| Investment | Risk | Return | Effort |

|---|---|---|---|

| Dividend Stocks | Medium | Medium | Low |

| ETFs | Low-Medium | Medium | Very Low |

| REITs | Medium | Medium | Low |

| Rental Property | Medium-High | High | Medium |

| Savings | Low | Low | None |

| Bonds | Low | Low-Medium | None |

🧮 How Much Do You Need to Start?

Example:

$10,000 in 5% yield = $500/year

Scaling capital increases passive income.

⚠️ Risks to Consider

- Market volatility

- Interest rate changes

- Property vacancies

- Default in lending

Diversification reduces risk.

🧠 Strategy for Beginners

Start with:

- Index fund

- Dividend ETF

- High-yield savings

Then expand.

💡 Passive Income vs Active Income

| Passive | Active |

|---|---|

| Asset-based | Time-based |

| Scalable | Limited |

How Inflation Affects Passive Income Investments

Inflation reduces the purchasing power of money. If your investment returns are lower than inflation, you’re actually losing value.

Inflation-Resistant Passive Investments

✔ Dividend growth stocks

✔ REITs (rents rise with inflation)

✔ Index funds

✔ Rental property

Low-yield savings or fixed CDs may struggle to beat inflation long term.

🧠 The “Income vs Growth” Strategy

Passive investors often choose between:

| Strategy | Focus | Best For |

|---|---|---|

| Income Investing | Regular cash flow | Retirees |

| Growth Investing | Capital appreciation | Younger investors |

Smart investors combine both:

- Dividend ETFs (income)

- Index funds (growth)

📊 How Much Passive Income Do You Need?

Example goal: $2,000 per month passive income

If average return = 5%

Required capital ≈ $480,000

This shows why reinvesting earnings is critical.

🔄 Reinvesting Dividends (The Compounding Engine)

Instead of withdrawing dividends:

✔ Reinvest automatically

✔ Buy more shares

✔ Increase future payouts

This is how wealth snowballs.

🏦 Tax Considerations for Passive Income (USA)

Different passive incomes are taxed differently:

| Investment | Tax Type |

|---|---|

| Dividends | Ordinary/Qualified tax |

| Rental income | Income tax |

| REIT payouts | Ordinary income |

| Savings interest | Income tax |

Tax-efficient accounts like IRAs help reduce burden.

📈 Risk Diversification Strategy

Don’t rely on one passive source.

Balanced portfolio example:

- 40% Index Funds

- 20% Dividend ETFs

- 20% REITs

- 10% Bonds

- 10% Cash/Savings

🧮 Passive Income at Different Life Stages

20s–30s

Focus on growth: Index funds, ETFs

40s–50s

Balance growth + income: REITs + dividends

60+

Income-focused: Bonds, dividends, rentals

🔐 How to Start With Small Capital

Even $500–$1,000 can start:

✔ Fractional shares

✔ ETFs

✔ High-yield savings

Consistency beats large one-time investments.

🚨 Common Passive Income Mistakes

❌ Chasing high yields blindly

❌ No diversification

❌ Ignoring taxes

❌ Not reinvesting

❌ Panic selling

📉 Market Crash Strategy

Passive investors should:

✔ Continue investing

✔ Reinvest dividends

✔ Avoid emotional selling

Crashes often create best buying opportunities.

🧠 Psychological Side of Passive Income

Passive investing reduces financial stress but requires patience. Markets fluctuate, but discipline wins.

📊 Rule of 72 (Powerful Insight)

Divide 72 by your return rate.

At 8% return → money doubles in 9 years.

🏁 Long-Term Wealth Formula

Wealth = Capital × Time × Return × Discipline

Passive income is a marathon, not a sprint.

The “Cash Flow vs Appreciation” Passive Income Debate

Many investors misunderstand passive income because they focus only on monthly cash flow. But passive wealth comes from two sources:

| Type | Meaning | Example |

|---|---|---|

| Cash Flow | Regular income | Dividends, rent |

| Appreciation | Asset value growth | Stocks, property |

Smart investors combine both. For example:

- REITs → cash flow

- Index funds → appreciation

Together they build sustainable wealth.

📉 How Interest Rates Impact Passive Income Investments

Interest rate changes influence returns:

When Rates Rise

- Bond yields improve

- Savings accounts pay more

- REITs may drop short term

When Rates Fall

- Stocks often rise

- REIT values increase

- Bond yields drop

Understanding this helps you shift allocation smartly.

🏦 Using Retirement Accounts for Passive Income

Passive investing becomes more powerful inside:

✔ Roth IRA

✔ Traditional IRA

✔ 401(k)

Benefits:

- Tax-deferred or tax-free growth

- Automatic investing

- Long-term compounding

📊 The “4% Rule” for Passive Income

Common retirement rule:

You can withdraw 4% of your portfolio annually without running out of money.

Example:

$500,000 × 4% = $20,000/year passive income.

🔄 Building Multiple Income Streams

Never rely on one source.

Example portfolio:

- Dividends

- REIT income

- Savings interest

- Online side business

Multiple streams = financial safety.

🧮 Passive Income From $10K, $50K, and $100K

| Investment | $10K | $50K | $100K |

|---|---|---|---|

| 5% yield | $500/yr | $2,500/yr | $5,000/yr |

| 8% yield | $800/yr | $4,000/yr | $8,000/yr |

Shows importance of scaling capital.

📉 Passive Income vs Inflation Trap

If return < inflation → wealth shrinks.

Aim for:

- Dividend growth stocks

- Real estate

- Equity funds

These historically beat inflation.

💡 Automating Passive Investments

Use automation to stay disciplined:

✔ Auto-invest plans

✔ Dividend reinvestment (DRIP)

✔ Automatic savings transfers

Removes emotional decisions.

🚨 High-Yield Passive Income Scams to Avoid

Beware of:

❌ Guaranteed returns

❌ “Too good to be true” schemes

❌ Crypto yield traps

❌ Unregulated platforms

Safe passive income is usually steady, not explosive.

📊 How Long It Takes to See Results

Passive income is slow early.

| Year | Growth Pattern |

|---|---|

| 1–2 | Slow |

| 3–5 | Noticeable |

| 6–10 | Strong |

| 10+ | Compounding explosion |

Patience is key.

🧠 Behavioral Advantage of Passive Investors

Successful passive investors:

- Ignore daily noise

- Focus on long-term

- Reinvest profits

- Stay diversified

Most people fail due to emotions, not strategy.

🔐 Emergency Fund Before Passive Investing

Always keep 3–6 months of expenses before investing aggressively. This prevents forced selling during emergencies.

📈 The Snowball Effect of Reinvestment

Example:

$20,000 at 8% return reinvested grows to $43,000 in 10 years without adding more money.

🏁 Ultimate Passive Income Blueprint

Step 1 → Emergency fund

Step 2 → Index funds

Step 3 → Dividend ETFs

Step 4 → REITs

Step 5 → Scale capital

Step 6 → Reinvest

This system builds financial independence.

❓ Frequently Asked Questions (FAQs)

Q1. Is passive income truly passive?

Mostly, but monitoring is needed.

Q2. What’s the safest option?

High-yield savings & bonds.

Q3. Best for beginners?

ETFs + savings.

🏁 Final Thoughts

Passive income is about building assets that work for you. The key is diversification, patience, and reinvestment.

Also read: Personal Loan or Bad Credit

Also read: Debt Consolidation Loan With Poor Credit

One Comment