Cheap and Best 5 Government Insurance in India

Government insurance schemes in India play a pivotal role in providing financial security to its citizens, especially economically vulnerable groups. These plans serve as a safety net against unexpected events such as illness, accidents or natural calamities and are meant to offer protection. We will look at various government insurance plans available here in India along with their benefits and how to take advantage of them; additionally, we will answer frequently asked questions (FAQs).

What Is Government Insurance?

Government insurance refers to insurance schemes sponsored and administered by governments for financial protection against various risks for individuals. These plans aim to ensure even economically vulnerable populations can gain access to coverage at reasonable premium rates; their primary goal is easing any unexpected events such as health problems, accidents or emergencies that might otherwise lead to significant financial strain.

Best 5 Government Insurance Schemes in India

1. Pradhan Mantri Jan Arogya Yojana (PMJAY)

Overview: Also referred to as Ayushman Bharat, PMJAY is a health insurance scheme created to offer free healthcare services for economically weaker members of society. This plan covers medical and hospitalization expenses associated with secondary and tertiary care procedures.

Benefits: Covering up to Rs 5 lakh annually per family, it provides access to over 1,350 medical procedures with cashless and paperless access in participating hospitals.

How To Avail: Beneficiaries can quickly check their eligibility on the PMJAY official website, and E-Cards are issued to eligible families, which can be used at hospitals participating in the scheme.

2. Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Overview: PMSBY is an accidental death and disability insurance scheme intended to provide coverage in case of accidents leading to unexpected deaths or disabilities.

Benefits: Indemnify accidental deaths up to Rs 2 lakh with accidental death coverage of Rs 2 lakh; secure permanent total disability coverage of Rs 2.5 lakh and partial disability coverage of up to Rs 1 lakh, respectively, at an annual premium of Rs 12. To avail yourself: To get these coverages you simply have to follow two simple steps.

How to avail: Firstly you have an accident plan, followed by permanent total disability and partial disability plans at an annual premium of Rs 12. And once they are in place you just pay an annual premium of Rs 12 and get covered.

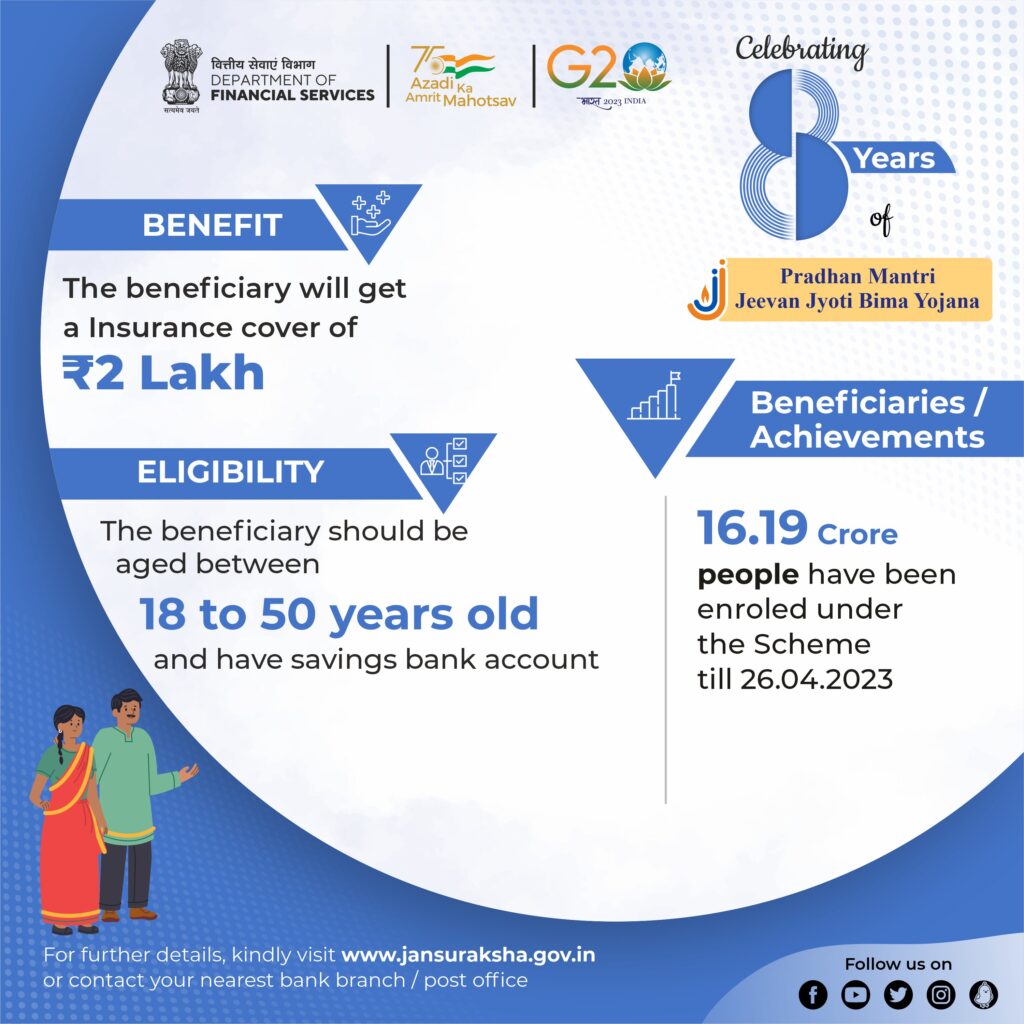

3. Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Overview: PMJJBY is a life insurance scheme designed to provide coverage in case of death due to any reason, making this option available to individuals aged 18-70 years. Subscription can be done via participating banks and insurance companies. It provides individuals aged 18 to 70 years an affordable way of protecting themselves financially should their lives end prematurely due to any circumstance.

Benefits: Life coverage of Rs 2 lakh; an annual premium of Rs 330 is charged; to avail of this insurance cover is straightforward and accessible.

How Can It Be Obtained: Subscription can be done through participating banks and insurance companies.

4. Atal Pension Yojana (APY)

Overview: APY is a pension plan designed to ensure an uninterrupted stream of income upon retirement for workers employed in the unorganized sector.

Benefits: On joining, participants are guaranteed a minimum monthly pension between Rs 1,000 to Rs 5,000; contributions vary based on age at joining and desired pension amount.

How to Avail: Individuals aged 18-40 years can join this scheme and subscriptions can be done through banks and post offices.

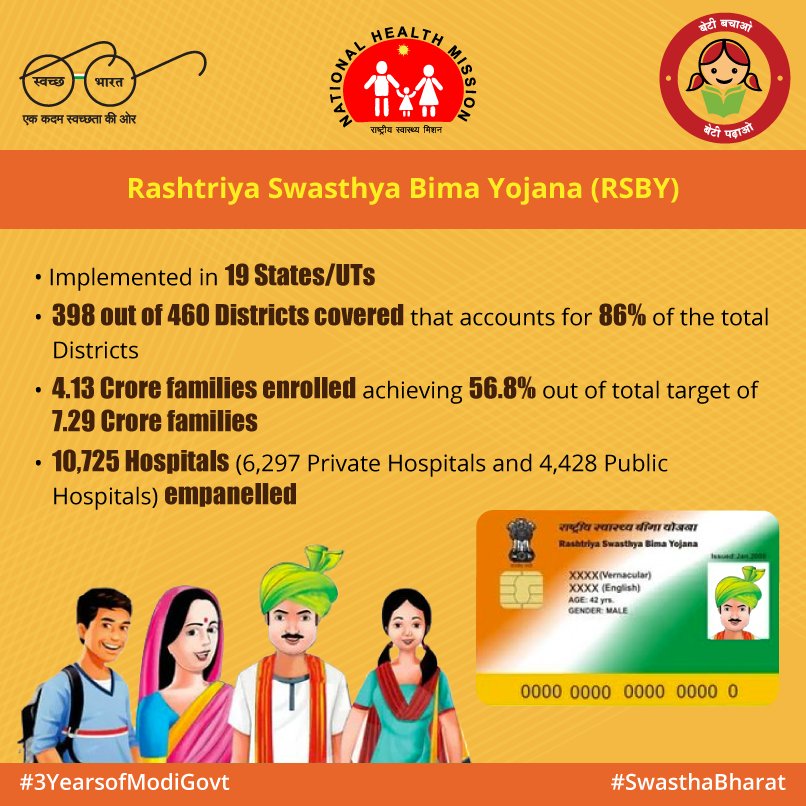

5. Rashtriya Swasthya Bima Yojana (RSBY)

Overview: The Rashtriya Swasthya Bima Yojana (RSBY) provides health coverage to families below the poverty line (BPL). It’s available exclusively in states like Uttar Pradesh.

Benefits: Up to Rs 30,000 in coverage per family per year is offered, covering hospitalization as well as certain daycare procedures.

How To Avail: Eligible families are identified and issued smart cards by the state government; services can then be availed of at hospitals that have agreed to accept these services.

Pradhan Mantri Jan Arogya Yojana (PMJAY) Of all the government insurance schemes available today, one that stands out among them all as outstanding is Pradhan Mantri Jan Arogya Yojana (PMJAY).

With its comprehensive coverage and wide reach, let us explore why PMJAY stands out:

PMJAY provides comprehensive coverage, with an annual coverage amount of Rs 5 lakh per family, far outstripping other schemes and ensuring beneficiaries can access a wide variety of medical treatments without worry over costs.

Wide Network of Hospitals

The scheme features a vast network of affiliated hospitals across India, giving insured people easy access to health care even in remote areas. Furthermore, their cashless and paperless system makes the experience seamless and user-friendly.

Inclusivity

PMJAY was designed to reach those most in need, from economically weaker sections and those living below the poverty level to those who require its benefits most. Through this inclusivity, benefits will reach those who require them most.

PMJAY Emphasizes Secondary and Tertiary Care

In contrast with many health insurance plans that emphasize primary care only, PMJAY places an emphasis on secondary and tertiary care – which includes treatments for serious illnesses as well as surgeries or medical procedures, offering comprehensive healthcare support.

Preventive Health Coverage In addition to covering treatments and hospitalization expenses, PMJAY also emphasizes preventive healthcare. This involves regular checkups and screenings which can assist in early diagnosis and treatment of different medical conditions.

How to Benefit From Government Insurance Schemes (PDF)

Understand Your Eligibility

Each government insurance scheme has specific eligibility criteria that it’s essential to understand in order to identify which schemes you qualify for, for instance, PMJAY is intended for economically weaker sections while APY targets unorganized sector workers.

Assure You Have Necessary Documents Before applying for any government insurance scheme, make sure you have all the necessary documents ready. This may include identity proof, address proof, income certificate and any other relevant paperwork.

Regularly Update Your Information

Should any significant changes arise to your personal information, such as moving addresses or changing contact details, make sure that this is communicated to all relevant authorities to continue receiving benefits uninterrupted.

Many beneficiaries fail to fully take advantage of the benefits provided by government insurance schemes. Be sure to utilize their services when needed and attend regular health check-ups if they’re covered under your plan.

Stay Informed

Remain informed on any updates or changes in government programs or schemes. Remaining up-to-date will enable you to take full advantage of any available benefits.

FAQs on government insurance schemes

Q1. Who is eligible for PMJAY?

A: PMJAY primarily targets economically weaker segments of society. Eligibility for this scheme is determined based on Socio-Economic Caste Census (SECC) data.

Q2. How can I check my eligibility for PMJAY?

A: You can check your eligibility for PMJAY online on its official website by providing your mobile phone number and verifying it using an OTP.

Q3. What is the annual premium for PMSBY?

A: The annual premium for PMSBY is Rs12.

Q4. Can I enrol in multiple government insurance schemes?

A: Absolutely provided you meet each scheme’s eligibility requirements.

Q5. How can I enrol in PMJJBY?

A: You can sign up with PMJJBY through your bank or insurance provider by filling out an application form and paying an annual premium of Rs 330.

Q6. What is the coverage amount under RSBY?

A: RSBY provides up to Rs 30,000 worth of protection per family each year.

Q7. Is there an age limit for APY?

A: Individuals aged 18-40 years are welcome to register in APY.

Q8. How can I avail of the benefits under PMJAY?

A: To access PMJAY benefits, present your e-card at any hospital that participates in this initiative and present them your details for verification before providing necessary treatments.

Q9. What documents are required for enrolling in PMSBY?

A: In order to enrol, it is necessary to present Aadhaar Card details, and bank account information and sign an Application form.

Q10. Can NRIs avail of government insurance schemes in India?

A: Unfortunately, government insurance schemes in India are designed for residents. Although non-resident Indians may not qualify for these plans, other options available for them exist to provide adequate insurance protection.

Conclusion

Government insurance schemes in India serve as an essential safety net for millions of citizens from economically weaker sections. These schemes offer benefits such as health and accident coverage as well as life and pension protection – the Pradhan Mantri Jan Arogya Yojana (PMJAY) stands out among its peers with its wide reach and comprehensive approach.

Understanding the various government insurance schemes, their benefits and eligibility criteria is the key to making smart decisions for yourself and your family’s safety. Get informed, utilize benefits offered to you, and take full advantage of government efforts to provide financial security to its citizens.

I am really impressed along with your writing skills and

also with the structure to your blog. Is that this a paid theme or did you customize

it yourself? Anyway stay up the nice high quality writing,

it’s rare to see a great blog like this one today. LinkedIN Scraping!