How to Invest in 401k Wisely (Complete Smart Guide)

Welcome to Maintain Market; we post finance, investment, insurance, and loan blogs. In this blog, we will talk about How to Invest in 401k Wisely.

A 401(k) plan is one of the most powerful wealth-building tools available to American workers. Yet many people contribute money without knowing how to invest inside their 401(k) wisely. Poor choices can reduce retirement wealth by hundreds of thousands of dollars, while smart strategies can help you retire comfortably.

This guide will explain how a 401(k) works, investment options, asset allocation, risk strategies, common mistakes, and expert tips to maximize your retirement savings.

📌 What Is a 401(k)?

A 401(k) is an employer-sponsored retirement savings plan that allows you to invest pre-tax or after-tax money for retirement.

Key Benefits:

✔ Tax advantages

✔ Employer matching

✔ Automatic investing

✔ Long-term compounding

🧠 Why Investing Wisely Matters

Two people saving the same amount can end up with very different retirement balances based on investment choices.

Example:

$500/month for 30 years

6% return → $502,000

9% return → $917,000

Investment strategy makes a huge difference.

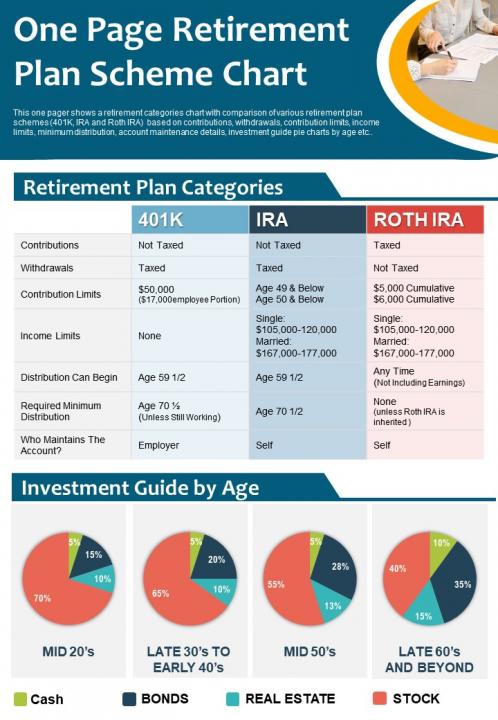

📊 Types of 401(k) Plans

| Type | Tax Benefit |

|---|---|

| Traditional 401(k) | Tax-deferred |

| Roth 401(k) | Tax-free withdrawals |

Choose based on expected retirement tax bracket.

🏆 Step 1: Get the Employer Match First

If your employer matches contributions, that’s free money. Always contribute enough to get the full match.

🧮 Step 2: Choose the Right Asset Allocation

General rule:

| Age | Stocks | Bonds |

|---|---|---|

| 20s | 80–90% | 10–20% |

| 30s | 70–80% | 20–30% |

| 40s | 60–70% | 30–40% |

| 50s | 50–60% | 40–50% |

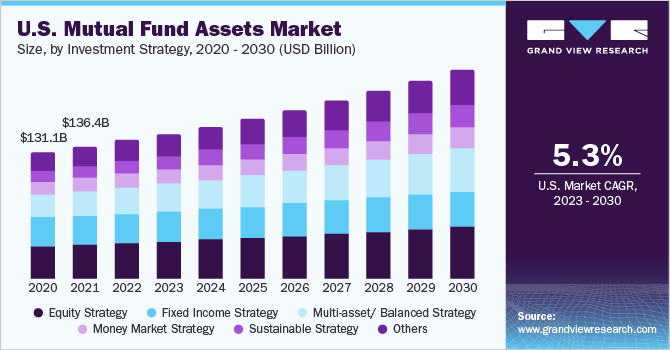

📈 Step 3: Use Low-Cost Index Funds

Index funds provide:

✔ Diversification

✔ Low fees

✔ Strong long-term returns

💰 Step 4: Diversify Properly

Mix of:

- U.S. stocks

- International stocks

- Bonds

Avoid putting all money in company stock.

🔄 Step 5: Rebalance Annually

Market movements change allocations. Rebalance once a year.

⚠️ Common 401(k) Mistakes -How to Invest in 401k Wisely

❌ Ignoring fees

❌ Too much cash

❌ Not increasing contributions

❌ Early withdrawals

📉 Market Crash Strategy

Do not panic sell. Continue contributions during downturns.

🧠 Target-Date Funds (Simple Option)

Automatically adjust asset allocation as you age.

💡 How Much Should You Contribute?

Aim for 15% of income including employer match.

📊 401(k) vs IRA

401(k) = employer plan

IRA = personal retirement account

Both can be used.

🧮 Compounding Example

$10,000 at 8% for 30 years → $100,000+

📉 How Fees Can Secretly Reduce Your 401(k) Growth

Even a small fee difference matters.

| Annual Fee | Balance After 30 Years ($500/mo @ 8%) |

|---|---|

| 0.5% | $745,000 |

| 1.5% | $635,000 |

A 1% fee difference can cost over $100,000. Always choose low-expense funds.

🧠 The “Set It and Grow It” Mindset

401(k) investing works best when you:

✔ Automate contributions

✔ Avoid frequent changes

✔ Let compounding work

Emotional decisions often reduce returns.

🔄 Contribution Increase Strategy

Each time you get a raise, increase your contribution by 1–2%. Over time this builds wealth without feeling painful.

📊 Roth vs Traditional 401(k): When to Choose

| Situation | Better Choice |

|---|---|

| Lower income now | Roth |

| High income now | Traditional |

| Expect higher taxes later | Roth |

| Expect lower taxes later | Traditional |

💡 Diversification Inside a 401(k)

A well-balanced portfolio often includes:

- Large-cap funds

- Small-cap funds

- International funds

- Bond funds

Avoid concentrating in one fund.

📈 Market Downturn Advantage

When markets drop:

✔ Your contributions buy more shares

✔ Long-term growth potential increases

This is called dollar-cost averaging advantage.

🧮 401(k) Contribution Limits

For 2026 (approx):

- Under 50: ~$23,000/year

- 50+: Extra catch-up contribution

Maxing contributions accelerates retirement readiness.

🏦 Loans From 401(k) — Should You?

Generally not recommended because:

❌ Stops growth

❌ Risk if job changes

❌ Tax penalties if not repaid

🚨 Early Withdrawal Penalties

Withdrawing before age 59½ usually triggers:

- Income tax

- 10% penalty

Avoid unless absolutely necessary.

📉 Rebalancing During Market Swings

Markets shift allocation over time. Annual rebalancing keeps risk level appropriate.

🧠 Psychological Rule: Ignore Daily Market News

Retirement investing is long-term. Daily headlines create unnecessary fear.

📊 Target-Date Fund vs DIY Investing

| Feature | Target-Date | DIY |

|---|---|---|

| Simplicity | High | Medium |

| Control | Low | High |

| Fees | Moderate | Low |

💰 Example Retirement Scenario

Saving $600/month for 35 years at 8% = $1.1 million

Consistency matters more than timing.

📊 How Inflation Impacts Your 401(k)

Inflation reduces purchasing power over time. If your investments grow at 6% but inflation averages 3%, your real return is only 3%.

That’s why 401(k) portfolios need:

✔ Stocks for growth

✔ Diversification

✔ Long-term compounding

Keeping too much in cash or bonds may feel safe but can lose value in real terms.

🧠 The Rule of 72 for Retirement Growth

Divide 72 by your expected return to see how long your money takes to double.

| Return | Years to Double |

|---|---|

| 6% | 12 years |

| 8% | 9 years |

| 10% | 7 years |

Higher long-term returns dramatically increase retirement wealth.

🔄 How Often Should You Check Your 401(k)?

✔ Review once or twice a year

❌ Checking daily causes emotional decisions

Long-term investing works best with patience.

💰 Employer Stock in 401(k): Is It Safe?

While investing in your employer may seem safe, too much concentration increases risk. If company stock falls and you lose your job, both income and retirement savings suffer.

Experts suggest:

✔ Keep employer stock under 10–15%

📈 Sequence of Returns Risk (Near Retirement)

Market drops just before retirement can reduce income potential.

Solution:

- Shift more to bonds as retirement approaches

- Keep emergency funds

- Avoid panic selling

🧮 Safe Withdrawal Strategy in Retirement

The 4% rule helps ensure savings last.

Example:

$1,000,000 → $40,000/year income.

Adjust withdrawals during market downturns.

🏦 What Happens to Your 401(k) When You Change Jobs?

Options include:

- Leave it in old plan

- Roll over to new employer plan

- Transfer to IRA

Rolling into IRA often provides more investment choices.

🚨 Required Minimum Distributions (RMDs)

After a certain age, the IRS requires withdrawals from traditional 401(k)s. Planning ahead reduces tax surprises.

📉 Why Staying Invested Matters

Missing just the best 10 market days over decades can cut returns dramatically. Staying invested improves long-term outcomes.

🧠 Behavioral Discipline = Bigger Retirement

Consistent investors outperform emotional traders. Avoid reacting to short-term market swings.

📊 Example Portfolio for a 35-Year-Old

- 60% U.S. index fund

- 20% international fund

- 15% bond fund

- 5% small-cap fund

Balanced for growth and stability.

🔐 Emergency Fund Before Investing More

Always keep 3–6 months of expenses in savings so you don’t need early withdrawals.

Frequently Asked Questions (FAQs) About Investing in a 401(k)

Q1. What is the best way to invest in a 401(k)?

The best approach is to:

✔ Contribute enough to get the employer match

✔ Choose low-cost index funds

✔ Diversify across stocks and bonds

✔ Rebalance annually

Q2. How much should I contribute to my 401(k)?

A common recommendation is 10–15% of your salary, including employer match. The more you contribute early, the more compounding works in your favor.

Q3. Should I choose Roth or Traditional 401(k)?

a) Choose Roth if you expect higher taxes in retirement.

b) Choose Traditional if you want tax savings now.

Q4. Is it risky to invest in stocks inside a 401(k)?

Stocks fluctuate short term but historically provide higher long-term growth. Younger investors can hold more stocks, while older investors should balance with bonds.

Q5. What funds should I pick in my 401(k)?

Good options include:

S&P 500 index funds

Total stock market funds

Bond index funds

Target-date funds

Q6. How often should I rebalance my 401(k)?

Once per year is usually enough to keep your asset allocation aligned with your goals

Q7. Can I lose money in a 401(k)?

Yes, markets fluctuate. However, long-term investing reduces the impact of short-term losses.

Q8. What happens if I withdraw early?

Withdrawals before age 59½ usually result in:

❌ Income tax

❌ 10% penalty

Q9. Should I invest all my 401(k) in employer stock?

No. Limit employer stock to avoid over-concentration risk.

Q10. Are target-date funds good?

Yes, they automatically adjust risk over time, making them ideal for beginners.

Q11. What is the biggest mistake in 401(k) investing?

Not contributing enough, ignoring fees, and panic selling during market downturns.

Q12. How does compounding help in a 401(k)?

Your earnings generate more earnings over time, accelerating growth the longer you stay invested.

Q13. Can I move my 401(k) when changing jobs?

Yes. You can roll it over into a new employer plan or an IRA.

Q14. What is a good return for a 401(k)?

Historically, stock-heavy portfolios average 7–10% annually over long periods.

Q15. How can I grow my 401(k) faster?

✔ Increase contributions regularly

✔ Choose low-fee funds

✔ Stay invested during downturns

✔ Reinvest dividends

🏁 Final Thoughts

Investing wisely in a 401(k) means:

✔ Get match

✔ Choose low-cost funds

✔ Diversify

✔ Stay consistent

Also read: Safest Investment With High Returns USA

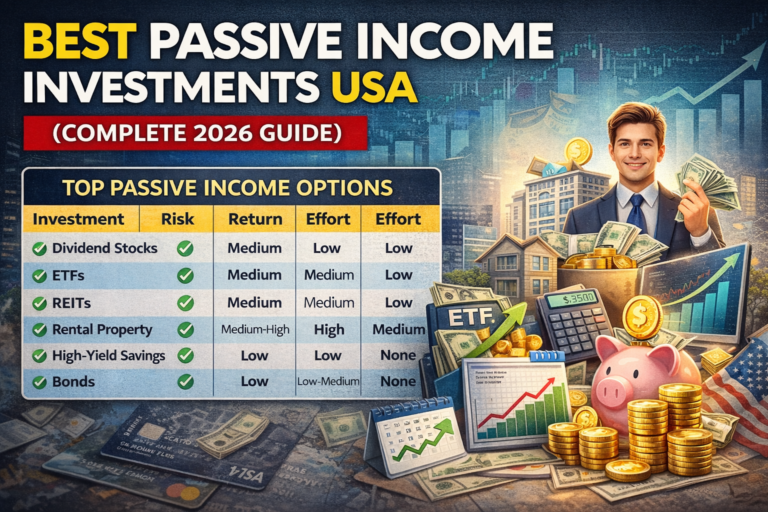

Also read: Best Passive Income Investments USA