-

-

Loan | Blog | Personal Finance

Unsecured Debt Consolidation Loan US – 2026 Complete Guide

Welcome to Maintain Market, the platform where we post content on finance, investment, debt, and loans. The content below is all about Unsecured Debt Consolidation loan US.

-

Blog | Loan | Personal Finance

Debt Consolidation Loan USA (2026 Complete Guide to Reduce Debt Faster)

Welcome to the Maintainmarket website. You are in the right place if you are searching for Debt Consolidation Loan USA. Debt has become a growing problem for millions of Americans. Credit cards, personal loans, medical bills, and payday loans can quickly pile up, making monthly payments stressful and confusing. This is where a debt consolidation … Read more

-

Mortgage Refinance Rates Today – Updated 2026 Complete Guide

Mortgage refinance rates today play a crucial role in determining whether refinancing your home loan will actually save you money or end up costing more in the long run. With interest rates constantly changing due to inflation, Federal Reserve policies, and global economic conditions, homeowners often wonder: Is now a good time to refinance my mortgage?

-

Loan | Blog | Personal Finance

Personal Loan for Bad Credit USA (2026 Complete Guide)

You are in the right place if you are looking for “Personal loan for Bad Credit USA”. Read more… Introduction: Can You Get a Personal Loan with Bad Credit in the USA? Yes, you can get a personal loan in the USA even with bad credit. Millions of Americans have credit scores below 600 due … Read more

-

Best Car Insurance for Low Credit Score (2026 Guide)

Introduction: Can You Get Car Insurance with a Low Credit Score? If you have a low credit score, getting affordable car insurance may feel impossible—but the truth is, you still have options. In countries like the United States, insurance companies often use a credit-based insurance score to help determine premiums. A lower score doesn’t mean … Read more

-

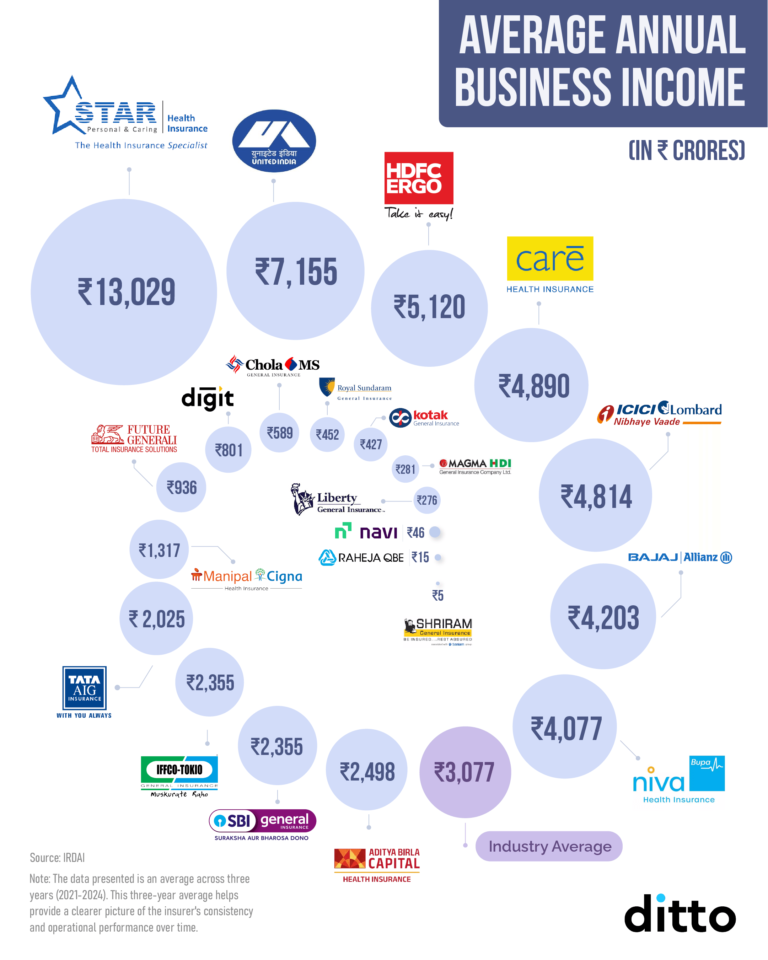

Best Health Insurance in India for Family (2026 Guide)

Healthcare costs in India are rising faster than income. A single hospitalization can easily cost ₹2–10 lakh, even in Tier-2 cities. This is why choosing the best health insurance in India for family is no longer optional—it’s a financial necessity. In this guide, you’ll learn: What Is Family Health Insurance? A family health insurance plan … Read more

-

Cheap and Best 5 Term Life Insurance

Term life insurance provides financial security to your family by covering a specified time period. Should the insured pass away during this timeframe, their death benefit will be distributed among their beneficiaries; should their term end while still alive then no payout will be made; acting as an affordable way of safeguarding future financial needs for their loved ones.

-

Cheap and Best 5 Government Insurance in India

Government insurance schemes in India play a pivotal role in providing financial security to its citizens, especially economically vulnerable groups. These plans serve as a safety net against unexpected events such as illness, accidents or natural calamities and are meant to offer protection. We will look at various government insurance plans available here in India … Read more

-

Loan | Blog | Personal Finance

Cheap and Best 5 Personal Loans: Compare Interest Rates & Apply

Personal loans have become an indispensable financial tool in India’s fast-paced society, providing essential support for many individuals to finance weddings, consolidate debt, cover medical expenses or take their dream vacation. This comprehensive guide will cover everything you need to know about personal loans – the top companies available in the Indian market; key features … Read more