Best Safest Investments With High Returns USA (Complete Guide)

Welcome to Maintain Market; we post finance, investment, insurance, and loan blogs. In this blog, we will talk about the safest investments with high returns USA.

Every investor wants the same thing: high returns without high risk. While no investment is completely risk-free, there are several safe or low-risk investments in the USA that provide stable and reliable returns when chosen wisely.

This guide explains the safest investment options, how they work, expected returns, risks, and smart strategies for building wealth with lower volatility.

📌 What Does “Safe Investment” Really Mean?

A safe investment is one that:

- Preserves capital

- Has low volatility

- Provides predictable returns

Safety usually comes from:

✔ Government backing

✔ Diversification

✔ Stable companies

✔ Fixed income structures

🏆 BEST SAFE INVESTMENTS WITH GOOD RETURNS

1️⃣ High-Yield Savings Accounts

Returns: 3%–5%

FDIC insured up to $250,000.

Best for emergency funds and short-term savings.

Pros:

✔ Zero risk

✔ Liquidity

Cons:

❌ Lower returns than stocks

2️⃣ Certificates of Deposit (CDs)

Returns: 4%–5%

Fixed-term deposits with guaranteed interest.

Best for: Medium-term goals.

3️⃣ U.S. Treasury Bonds & T-Bills

Backed by the U.S. government.

Returns: 3%–5%

Types:

- T-Bills (short-term)

- T-Notes

- T-Bonds

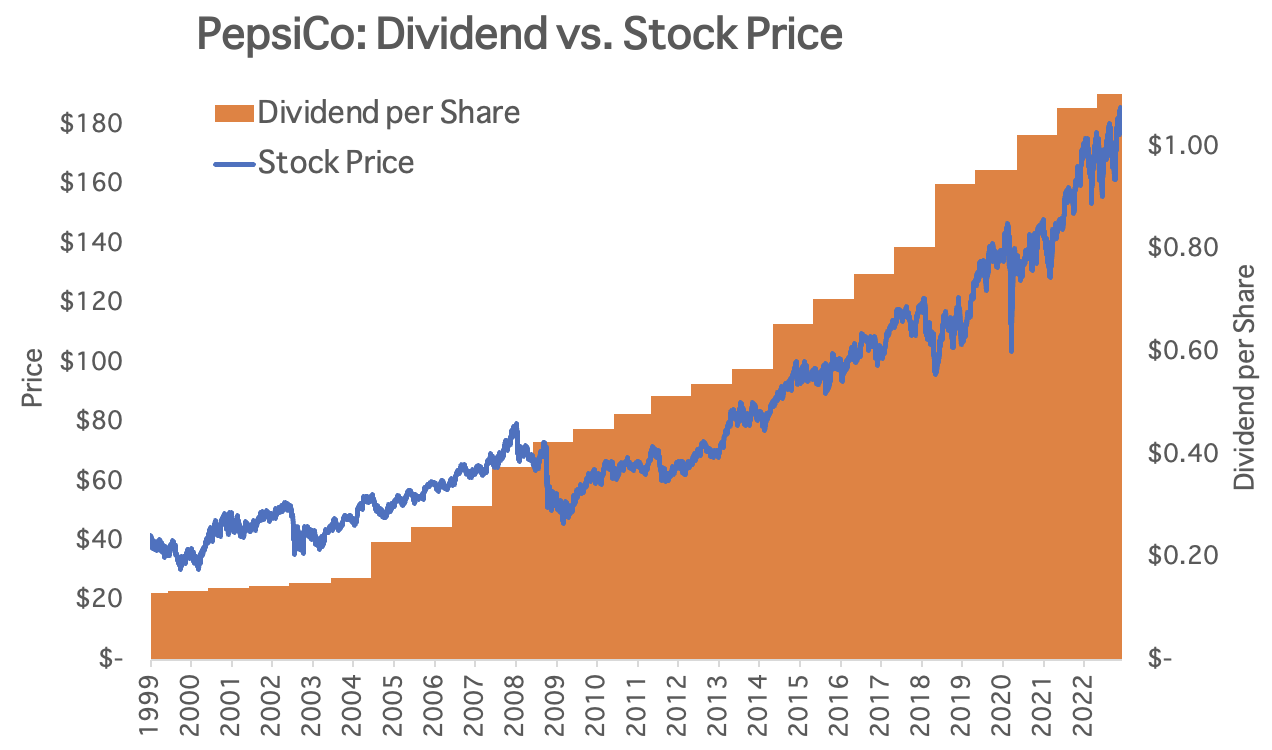

4️⃣ Dividend Stocks (Blue-Chip)

Examples:

- Johnson & Johnson

- Coca-Cola

Returns:

- Dividends 2%–6%

- Long-term growth

5️⃣ Dividend ETFs

Diversified basket of dividend stocks.

Safer than individual stocks.

6️⃣ Real Estate Investment Trusts (REITs)

Income from rental properties.

Returns: 4%–8%

7️⃣ Index Funds (S&P 500)

Long-term average: 8%–10%

Diversified across major companies.

8️⃣ Corporate Bonds

Higher yield than Treasuries.

9️⃣ Money Market Accounts

Higher rates than savings accounts.

🔟 Preferred Stocks

Hybrid of stocks and bonds.

📊 Comparison Table

| Investment | Risk | Return | Liquidity |

|---|---|---|---|

| Savings | Very Low | Low | High |

| CDs | Low | Low-Medium | Medium |

| Treasuries | Very Low | Low-Medium | Medium |

| Dividend Stocks | Medium | Medium | High |

| REITs | Medium | Medium | High |

| Index Funds | Medium | High (long term) | High |

🧠 Strategy to Balance Safety and Returns

Ideal allocation:

- 30% Index funds

- 20% Dividend ETFs

- 20% Bonds

- 15% REITs

- 15% Cash/Savings

💡 How Inflation Affects Safe Investments

Some safe assets lose value to inflation. Stocks and REITs help beat inflation.

📈 How Much You Need for Passive Returns

$200,000 at 5% = $10,000/year.

⚠️ Risks Even in Safe Investments

- Interest rate changes

- Market downturns

- Inflation erosion

Diversification reduces these.

📉 How “Safety” Changes With Time Horizon

An investment that’s safe for 1 year may not be safest for 20 years.

| Time Frame | Safest Options |

|---|---|

| 0–2 Years | High-yield savings, CDs, T-bills |

| 3–7 Years | Bonds, dividend ETFs |

| 10+ Years | Index funds, REITs, dividend stocks |

Longer timelines allow slightly higher risk for better returns.

🧠 The Myth of “Risk-Free High Returns”

Investments promising high return + zero risk are usually scams.

Real safe high-return strategies focus on:

✔ Diversification

✔ Long-term holding

✔ Stable cash-flow assets

📊 Blending Safety and Growth

Smart portfolios combine:

- Fixed income (stability)

- Equity (growth)

- Real assets (inflation protection)

This mix reduces volatility while keeping returns healthy.

💵 Monthly Income Strategy With Safe Investments

If goal = steady income:

- Dividend ETFs

- REITs

- Bonds

These provide periodic cash flow without selling assets.

🔄 Reinvestment Strategy for Safe Wealth Growth

Reinvesting dividends and interest increases compounding power.

Over time, reinvestment turns moderate returns into significant wealth.

📈 How Safe Investments Perform During Market Crashes

- Savings & Treasuries stay stable

- Dividend stocks drop but recover

- REITs fluctuate

Holding diversified safe assets prevents panic selling.

🏦 Tax Efficiency Tips

Use tax-advantaged accounts:

- IRA

- Roth IRA

- 401(k)

Reduces tax drag on safe returns.

🧮 Capital Needed for Different Income Goals

| Income Goal | Needed Capital (5% yield) |

|---|---|

| $5,000/year | $100,000 |

| $10,000/year | $200,000 |

| $20,000/year | $400,000 |

Shows importance of scaling.

🧠 Emotional Advantage of Safe Investing

Low-risk portfolios:

✔ Reduce stress

✔ Improve discipline

✔ Prevent panic selling

Consistency beats chasing trends.

🚨 Common Mistakes – Safest Investments With High Returns USA

❌ Over-concentration

❌ Ignoring fees

❌ Holding too much cash

❌ Chasing yield

🔐 Emergency Fund Before Investing

Always keep 3–6 months of expenses in safe savings.

📊 Safe Investments for Retirement

Older investors prefer:

- Bonds

- Dividend ETFs

- REIT income

Young investors can lean more toward growth.

📊 Historical Perspective: Safe vs Risky Investments

Historically in the U.S.:

| Asset | Long-Term Avg Return | Risk Level |

|---|---|---|

| Savings Accounts | 1–4% | Very Low |

| Treasury Bonds | 3–6% | Low |

| Dividend Stocks | 7–10% | Medium |

| Index Funds | 8–11% | Medium |

| REITs | 8–12% | Medium |

This shows that “safe” doesn’t always mean “low return” — stable equity assets often outperform fixed deposits over time.

🧠 The “Sleep Well at Night” Rule

A truly safe investment is one that:

✔ Lets you sleep peacefully

✔ Doesn’t cause panic in downturns

✔ Matches your risk tolerance

If volatility causes stress, your portfolio may be too aggressive.

🔄 Dollar-Cost Averaging (DCA) for Safety

Investing small amounts regularly reduces timing risk.

Example:

Invest $500 monthly instead of $6,000 once → smooths market swings.

💰 Safe Passive Income Ladder Strategy

Create layers of safety:

1️⃣ Emergency fund → savings

2️⃣ Stability → bonds & CDs

3️⃣ Growth → index funds

4️⃣ Income → dividends & REITs

This layered approach balances risk and return.

📉 How Market Cycles Affect “Safe” Investments

During recessions:

- Savings & Treasuries hold value

- Stocks dip but recover

- REITs fluctuate

Diversified portfolios recover faster than concentrated ones.

📊 Income Stability Score (Concept)

| Investment | Income Stability |

|---|---|

| Savings | ⭐⭐⭐⭐⭐ |

| Treasuries | ⭐⭐⭐⭐⭐ |

| Bonds | ⭐⭐⭐⭐ |

| Dividend ETFs | ⭐⭐⭐ |

| REITs | ⭐⭐⭐ |

Use stability as a factor when selecting safe assets.

🧮 The “Capital Preservation” Principle

Safe investors focus on:

✔ Avoiding large losses

✔ Accepting moderate gains

Avoiding big drops often leads to better long-term growth than chasing risky high returns.

🏦 Combining Safety With Liquidity

Liquid safe investments include:

- Savings accounts

- Money market funds

- ETFs

Liquidity prevents forced selling during emergencies.

📈 Why Safe Investors Still Beat Inflation

While savings may lag inflation, combining:

- Dividend growth stocks

- REITs

- Index funds

Helps maintain purchasing power.

🧠 Behavioral Benefits of Safe Portfolios

Safer portfolios:

✔ Encourage long-term holding

✔ Reduce emotional trading

✔ Improve compounding consistency

🚨 Yield Trap Warning – Safest Investments With High Returns USA

Very high yields often mean:

❌ Higher risk

❌ Unsustainable payouts

Always check:

- Company stability

- Dividend history

- Debt levels

📊 Building Safe Wealth in 5 Steps

- Build emergency fund

- Invest in index funds

- Add dividend ETFs

- Include bonds

- Reinvest earnings

📊 The Risk–Return Spectrum Explained

All investments fall on a spectrum:

| Low Risk | Medium Risk | Higher Risk |

|---|---|---|

| Savings, Treasuries | Bonds, Dividend ETFs | Growth stocks |

Safe investments aim to stay on the left to middle of this spectrum while still beating inflation.

🧠 The “Capital First” Rule

Professional wealth managers follow:

Rule #1: Don’t lose money

Rule #2: Remember rule #1

Safe investments prioritize protecting principal before chasing returns.

🔄 Laddering Strategy for Safe Returns

A CD or bond ladder means spreading maturity dates.

Example:

- 1-year CD

- 2-year CD

- 3-year CD

Provides liquidity and steady rate exposure.

💵 Monthly Cash Flow From Safe Assets

Investors can combine:

- Dividend ETFs

- Bond funds

- REIT payouts

To create predictable monthly or quarterly income.

📈 Why Compounding Is Safer Than Trading

Frequent trading increases risk. Long-term compounding with safe assets smooths volatility.

📉 Economic Downturn Protection

Safe investments act as shock absorbers during recessions.

Savings and Treasuries often rise when stocks fall.

🧮 The “Sleep-at-Night” Allocation Rule

If market drops cause panic, shift more to safe assets.

🏦 Safe Investing for Different Goals

| Goal | Best Safe Options |

|---|---|

| Emergency fund | Savings |

| Retirement income | Bonds + dividends |

| Wealth growth | Index funds + REITs |

📊 Long-Term Stability Example

A balanced portfolio historically shows fewer sharp drops and steadier growth compared to stock-only portfolios.

🧠 Psychological Advantage of Stability

Lower volatility improves investor discipline and prevents bad decisions.

🚨 Overconfidence Trap

Chasing past high returns often leads to higher risk than expected.

📈 Inflation-Protected Safe Assets

Treasury Inflation-Protected Securities (TIPS) help preserve purchasing power.

🧮 Why Safe Portfolios Outlast Aggressive Ones

Survival in markets matters more than high short-term gains.

🏁 Ultimate Safe Investment Mindset

Safe investing is not about:

“Getting rich fast”

It’s about:

✔ Preserving capital

✔ Earning steady returns

✔ Growing wealth consistently

❓ Frequently Asked Questions – FAQs

Q1. What is the safest high return investment?

Dividend ETFs + index funds.

Q2. Are bonds safe?

Government bonds re very safe.

🏁 Final Thoughts

Safe investing is about balancing stability with steady growth. Diversify and stay patient.

Also read: Debt Consolidation loan with poor credit

Also read: Best Car Insurance For Low Credit Score

One Comment