Sovereign Gold Bond Investment – Complete Guide for Indian Investors

Welcome to Maintain Market; we post finance, investment, insurance, and loan blogs. In this blog, we will talk about Sovereign Gold Bond Investment.

Gold has always been a trusted asset in India. But instead of buying physical gold, smart investors now prefer Sovereign Gold Bonds (SGBs) — a government-backed way to invest in gold with extra benefits.

This guide explains how SGB works, interest rate, returns, tax benefits, risks, and whether SGB is better than physical gold or gold ETFs.

📌 What Is a Sovereign Gold Bond (SGB)?

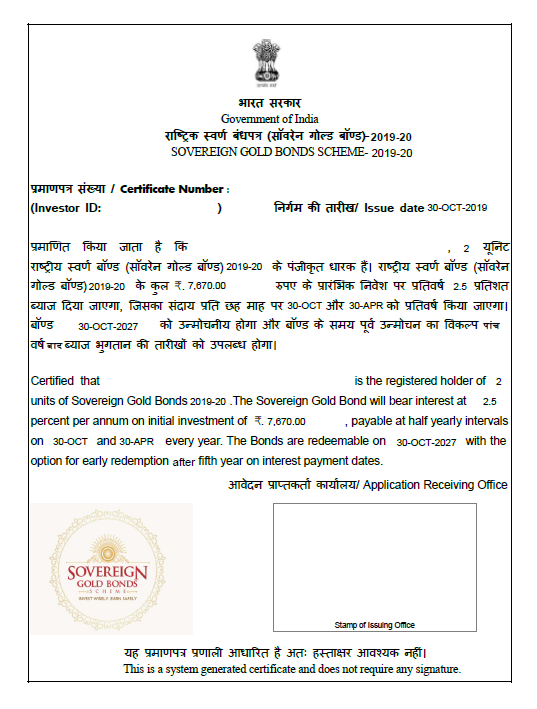

A Sovereign Gold Bond is a government security denominated in grams of gold. It is issued by the Reserve Bank of India on behalf of the Government of India.

Instead of holding physical gold, you hold a bond whose value is linked to gold prices.

🧠 Why SGB Is Considered a Smart Gold Investment

SGB combines:

✔ Gold price appreciation

✔ 2.5% fixed annual interest

✔ No storage risk

✔ Tax advantages

You earn from both gold price growth + interest income.

💰 How Sovereign Gold Bond Investment Works

- You buy SGB in grams of gold

- Tenure = 8 years (exit allowed after 5th year)

- Interest = 2.5% per year (paid semi-annually)

- Returns linked to gold market price

📊 SGB vs Physical Gold

| Feature | SGB | Physical Gold |

|---|---|---|

| Storage | No risk | Locker cost |

| Purity issues | None | Possible |

| Interest | 2.5% extra | No |

| Capital gains tax | Exempt on maturity | Taxable |

| Liquidity | Tradable | Immediate |

SGB is financially superior for long-term investors.

📈 How Returns Are Generated

SGB gives two types of returns:

1️⃣ Fixed interest (2.5%)

2️⃣ Gold price appreciation

If gold rises, your bond value rises.

🏦 Who Issues SGB?

Issued by RBI on behalf of Government of India. This makes it one of the safest investment instruments.

📅 Tenure & Exit Options

| Duration | Details |

|---|---|

| Total tenure | 8 years |

| Early exit | After 5 years (interest dates) |

💸 Minimum & Maximum Investment

- Minimum: 1 gram

- Maximum: 4 kg per individual per year

📊 Interest Payment Structure

Interest is credited to your bank account every 6 months.

💡 How to Buy SGB

You can buy through:

- Banks

- Post offices

- Stock exchanges

- Online banking platforms

Online purchases usually get discount.

🧠 Tax Benefits of SGB

✔ No capital gains tax if held till maturity

✔ Interest taxable as per slab

✔ No GST like physical gold

Huge advantage over jewellery or coins.

📉 Risks in SGB Investment

❌ Gold price volatility

❌ Interest rate fixed at 2.5%

❌ Long tenure

However, government backing reduces credit risk.

📈 Why SGB Beats Gold ETF

| Factor | SGB | Gold ETF |

|---|---|---|

| Interest | Yes | No |

| Expense ratio | No | Yes |

| Tax benefit | Yes | Limited |

🧮 Example Return Calculation

If you buy 10 grams at ₹5,000/g = ₹50,000

After 8 years gold = ₹7,000/g = ₹70,000

Interest earned = ₹10,000 approx

Total value ≈ ₹80,000+

🧠 Who Should Invest in SGB?

✔ Long-term investors

✔ Portfolio diversification seekers

✔ Inflation hedge

✔ Those avoiding physical gold hassle

📉 How Gold Price Movement Affects SGB Returns

SGB value directly depends on gold prices. If gold prices rise, bond value increases. If prices fall, bond value decreases — but you still earn 2.5% annual interest.

Factors influencing gold prices:

- Inflation

- Rupee vs dollar movement

- Global economic uncertainty

- Interest rates

- Central bank buying

Gold often rises during economic crises, making SGB a portfolio stabilizer.

🧠 Ideal Allocation of Gold in Portfolio

Financial planners recommend:

| Risk Profile | Gold Allocation |

|---|---|

| Conservative | 5% |

| Moderate | 10% |

| Aggressive | 10–15% |

Too much gold may reduce overall returns, so balance is key.

📊 SGB Liquidity Explained

Though SGB has 8-year maturity, you can sell:

✔ On stock exchanges

✔ After 5 years via RBI early redemption

However, secondary market prices may trade at discount or premium.

💰 SGB Interest vs FD Interest

| Feature | SGB | Fixed Deposit |

|---|---|---|

| Return type | Gold price + 2.5% | Fixed interest |

| Inflation hedge | Yes | No |

| Tax on maturity | Exempt | Taxable |

| Risk | Low | Low |

SGB offers growth + protection.

🔄 SGB Redemption Process

At maturity:

- RBI credits amount based on prevailing gold price

- Money directly transferred to bank account

No physical gold is delivered.

🧾 Capital Gains Tax Rules

| Scenario | Tax Treatment |

|---|---|

| Held till maturity | No capital gains tax |

| Sold before maturity on exchange | LTCG applies |

This makes SGB highly tax-efficient.

🏦 SGB vs Digital Gold

| Factor | SGB | Digital Gold |

|---|---|---|

| Govt-backed | Yes | No |

| Interest income | Yes | No |

| Storage risk | None | Company dependent |

| Tax benefit | Yes | Limited |

SGB is more reliable.

📈 When Is Best Time to Invest in SGB?

✔ During gold price corrections

✔ When RBI opens new tranches

✔ During inflation or global uncertainty

However, SGB should be part of long-term strategy, not short-term trading.

🧠 Who Should Avoid SGB?

❌ Short-term traders

❌ Investors needing liquidity within 5 years

❌ Those expecting very high equity-like returns

📊 How SGB Helps During Market Crash

When stock markets fall, gold often rises. SGB acts as hedge against market volatility.

📊 Historical Gold Performance in India

Gold has historically protected investors during:

- Inflation periods

- Currency depreciation

- Economic crises

- Global instability

Over long periods, gold prices in India have shown steady upward trends, making SGB a useful hedge.

🧠 Role of SGB in Diversified Portfolio

SGB is not meant to replace equity but to balance risk.

A sample diversified portfolio:

- 50% Equity mutual funds

- 20% Fixed income

- 10% Gold (SGB)

- 20% Cash/other assets

Gold reduces portfolio volatility.

📉 When Gold Prices Fall — What Should You Do?

Short-term dips are normal. Long-term investors should:

✔ Continue holding

✔ Avoid panic selling

✔ View dips as long-term entry points

🏦 SGB vs Physical Gold Jewellery

| Factor | SGB | Jewellery |

|---|---|---|

| Making charges | None | High |

| Storage | No | Locker needed |

| Liquidity | Moderate | High |

| Return | Price + interest | Price only |

SGB is better for investment; jewellery for consumption.

📈 Compounding Advantage of SGB Interest

Though interest is 2.5%, when reinvested, it compounds over time, improving effective return.

🧮 Gold Allocation Strategy by Age

| Age Group | Suggested Gold % |

|---|---|

| 20–35 | 5–10% |

| 36–50 | 10% |

| 50+ | 10–15% |

Older investors benefit more from stability.

🔄 Ladder Strategy for SGB

Instead of buying once, buy SGB across multiple tranches. This averages gold price risk.

📊 SGB Liquidity on Stock Exchanges

Though tradable, prices may differ from actual gold price due to demand and supply. Long-term holding gives better benefit.

🧠 Why SGB Is Inflation Hedge

Gold prices generally rise when currency value falls. SGB protects purchasing power.

💡 Combining SGB With Equity

During market crashes, equity may fall while gold rises. This balance protects portfolio.

🚨 Mistakes to Avoid in SGB

❌ Investing entire savings in gold

❌ Expecting short-term profits

❌ Ignoring portfolio balance

❌ Selling in panic

📈 Long-Term Wealth Stability

SGB doesn’t create explosive growth like stocks but offers:

✔ Stability

✔ Risk diversification

✔ Predictable interest

❓ Frequently Asked Questions (FAQs)

Q1. Is Sovereign Gold Bond safe?

Yes. It is backed by the Government of India.

Q2. Can I exit before 8 years?

Yes, after 5 years during interest payment dates.

Q3. Is SGB better than buying gold jewellery?

Yes , because jewellery includes making charges and no interest income.

Q4. How is SGB interest paid?

Semi-annually to your bank account.

Q5. Can NRIs invest?

No, only Indian residents.

Q6. Is there any GST on SGB?

No GST applies.

Q7. What happens if gold price falls?

Your bond value falls, but interest still earned.

Q8. Can SGB be used as collateral?

Yes, banks accept it as collateral.

Q9. What is minimum investment?

1 gram of gold.

Q10. Is SGB taxable?

Interest is taxable; capital gains on maturity are exempt.

🏁 Conclusion

Sovereign Gold Bonds offer:

✔ Safety

✔ Regular interest

✔ Tax benefits

✔ Inflation protection

They are one of the best gold investment options in India for long-term investors.