Best Health Insurance in India for Family (2026 Guide)

Healthcare costs in India are rising faster than income. A single hospitalization can easily cost ₹2–10 lakh, even in Tier-2 cities. This is why choosing the best health insurance in India for family is no longer optional—it’s a financial necessity.

In this guide, you’ll learn:

- Which family health insurance plans are truly worth buying

- How much premium you should realistically pay

- Which plan is best for parents, kids, salaried people, and senior citizens

- Real claim and hospital cost examples

- Comparison tables, FAQs, and tax benefits

What Is Family Health Insurance?

A family health insurance plan (also called family floater health insurance) covers multiple family members under one single sum insured.

Usually covered members:

- Self

- Spouse

- Children

- Parents (in some plans)

Instead of buying separate policies, you pay one premium and share the coverage.

Why Family Health Insurance Is Better Than Individual Plans

| Feature | Family Health Insurance | Individual Health Insurance |

|---|---|---|

| Premium | Lower | Higher |

| Coverage | Shared among family | Separate for each person |

| Policy management | One policy | Multiple policies |

| Tax benefit | Single deduction | Multiple deductions |

| Best for | Young families | Seniors / individuals |

👉 If you’re below 45 with children, family floater plans are the best value.

Best Health Insurance in India for Family (2026)

Below are the top-performing and most trusted family health insurance plans in India based on coverage, claim settlement, hospital network, and value for money.

🔝 Top Family Health Insurance Plans

| Insurance Company | Best Plan | Sum Insured | Starting Premium (₹/year) |

|---|---|---|---|

| HDFC ERGO | Optima Secure | ₹10–25 lakh | ₹13,500 |

| Star Health | Family Health Optima | ₹5–20 lakh | ₹11,200 |

| Niva Bupa | ReAssure 2.0 | ₹10–1 Cr | ₹14,000 |

| Care Health Insurance | Care Supreme | ₹10–1 Cr | ₹12,500 |

| ICICI Lombard | Complete Health | ₹5–20 lakh | ₹13,800 |

Best Health Insurance for Family – Detailed Review

✅ HDFC ERGO Optima Secure

Best for: Maximum coverage lovers

- 4X coverage without extra cost

- No room rent limit

- Covers daycare procedures

- Strong cashless hospital network

💰 Example:

You buy ₹10 lakh cover → You actually get ₹40 lakh coverage.

✔️ Ideal for metro city families

✅ Star Health Family Health Optima

Best for: Families with parents

- Excellent for senior parents

- In-house claim settlement

- Covers parents up to 65 years easily

- Good Tier-2 & Tier-3 hospital network

✔️ Trusted brand for Indian households

✅ Niva Bupa ReAssure 2.0

Best for: Unlimited recharge benefit

- Sum insured resets unlimited times

- Covers modern treatments

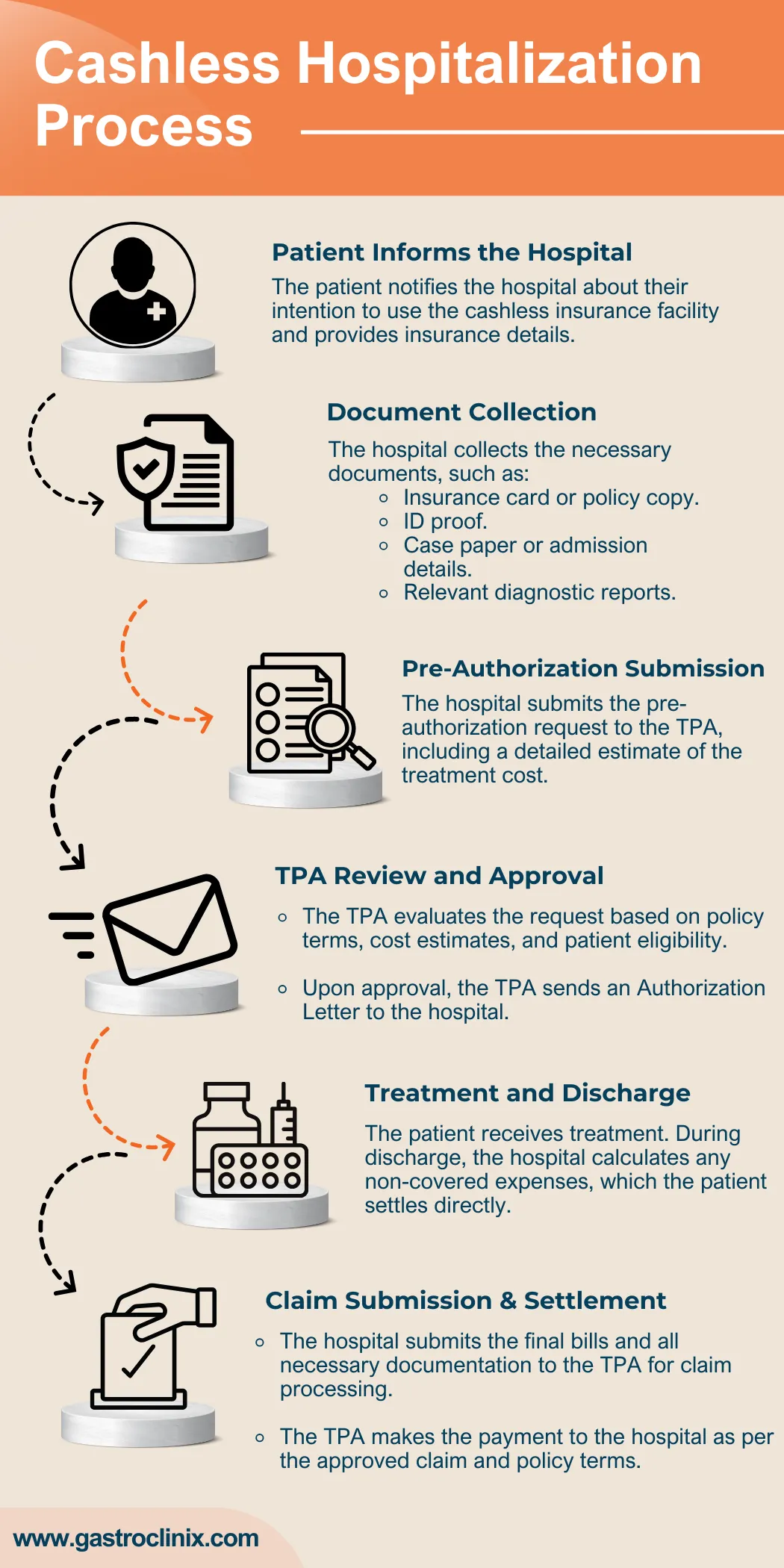

- Cashless claims in most private hospitals

✔️ Great for families with frequent hospital visits

✅ Care Supreme

Best for: High sum insured at low cost

- Coverage up to ₹1 crore

- Annual health checkups

- Inflation-proof benefits

✔️ Best for long-term planning

✅ ICICI Lombard Complete Health

Best for: Corporate-style benefits

- Wellness rewards

- OPD add-ons

- Strong digital support

✔️ Ideal for salaried professionals

Real Hospital Cost Example (India)

Let’s see why health insurance is critical.

Example: Appendix Surgery in Private Hospital

| Expense | Cost (₹) |

|---|---|

| Hospital room (4 days) | 48,000 |

| Surgery charges | 1,20,000 |

| Medicines | 22,000 |

| Tests & scans | 18,000 |

| Doctor fees | 25,000 |

| Total Cost | ₹2,33,000 |

👉 With family health insurance, you pay ₹0–5,000 instead of ₹2.33 lakh.

How Much Health Insurance Cover Does a Family Need?

| Family Type | Recommended Sum Insured |

|---|---|

| Couple | ₹10 lakh |

| Couple + 1 child | ₹10–15 lakh |

| Couple + 2 kids | ₹15–20 lakh |

| Family with parents | Separate parent policy |

💡 Pro tip: Never include senior parents in the same family floater.

Best Health Insurance for Family With Parents

Parents have higher claim probability, which increases premium for everyone.

Recommended Strategy:

- Separate policy for parents

- Family floater for self + spouse + kids

Best options for parents:

- Star Health Senior Citizen Plans

- Care Senior Health Plans

Tax Benefits on Family Health Insurance

Under Section 80D of Income Tax Act:

| Who is covered | Tax Deduction |

|---|---|

| Self + Family | ₹25,000 |

| Parents (<60) | ₹25,000 |

| Parents (≥60) | ₹50,000 |

| Maximum Benefit | ₹75,000 |

Common Mistakes to Avoid While Buying Family Health Insurance

❌ Choosing low sum insured

❌ Ignoring waiting periods

❌ Adding parents to family floater

❌ Not checking room rent limits

❌ Focusing only on premium, not coverage

Why Health Insurance Is More Important Today Than Ever Before (2026 Reality)

4

Just 10–15 years ago, a family could manage medical expenses from savings. That is no longer possible today.

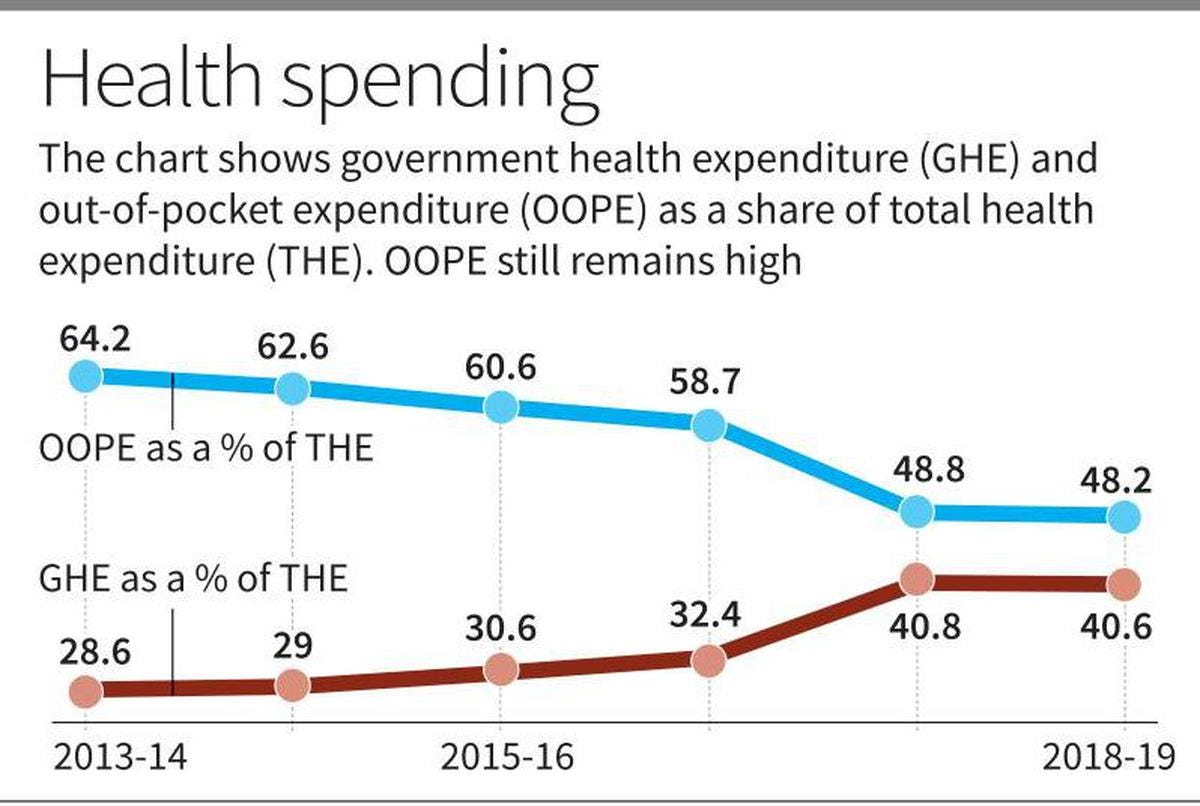

1️⃣ Medical Inflation Is Crushing Indian Families

Medical inflation in India is growing at 12–14% annually, which is 2x faster than salary hikes.

| Year | Avg Hospital Cost (₹) |

|---|---|

| 2015 | ₹80,000 |

| 2020 | ₹1.5 lakh |

| 2026 | ₹3–6 lakh |

👉 A ₹10 lakh surgery today can cost ₹18–20 lakh in the next 8–10 years.

Without health insurance, this money comes from:

- Fixed deposits

- Mutual funds

- Gold

- Emergency loans

That’s why health insurance is not an expense — it’s financial protection.

💥 One Medical Emergency Can Destroy Years of Savings

Real-Life Situation:

- Middle-class family

- ₹8–10 lakh total savings

- One ICU admission (COVID, dengue, heart issue)

💸 Result:

Savings = wiped out

Loans = taken

Stress = lifelong

👉 Health insurance ensures:

- Your investments stay untouched

- Your children’s education fund remains safe

- You don’t depend on relatives or loans

🧠 What Emotionally & Practically Makes Us Buy Health Insurance?

People don’t buy health insurance because they want to —

They buy it because they fear uncertainty.

These are the REAL buying triggers:

✔ Fear of sudden hospitalization

Accidents, infections, lifestyle diseases — they come without warning.

✔ Responsibility towards family

As a breadwinner:

- Your family depends on your income

- One illness = income + savings both at risk

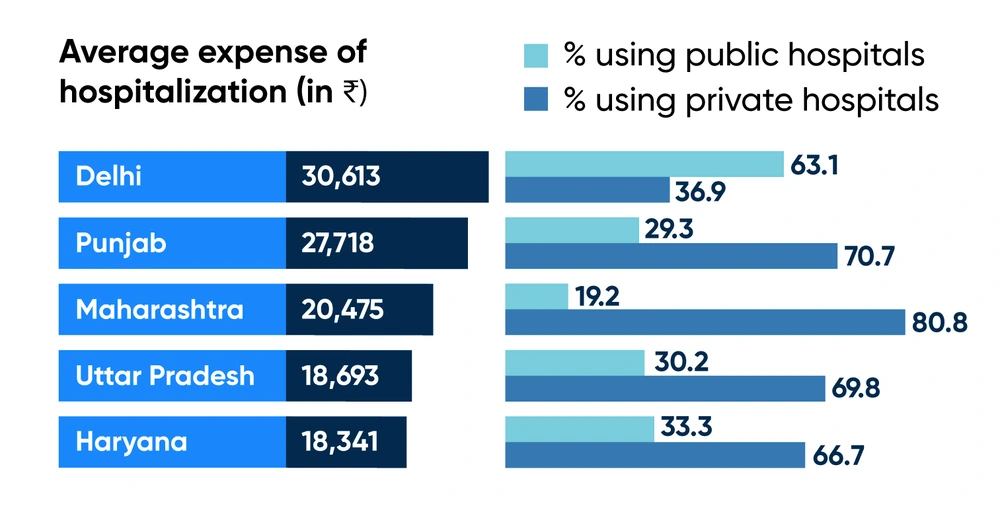

✔ Expensive private hospitals

Government hospitals are overcrowded.

Private hospitals require advance deposits of ₹50,000–₹2 lakh.

✔ Peace of mind

Knowing:

“Even if something happens, my family is protected.”

This peace of mind is priceless.

👨👩👧 Why Family Health Insurance Makes More Sense Than Individual Plans

Family floater plans are designed for:

- Young parents

- Working couples

- Families with children

Why it works:

- All members rarely fall sick at the same time

- Shared sum insured reduces cost

- Higher coverage at lower premium

💡 Example:

- 4 individual plans (₹5 lakh each) = expensive

- 1 family floater (₹20 lakh) = cheaper + flexible

🛡️ Health Insurance Is Also Income Protection

Many people think health insurance only pays hospital bills.

But its hidden benefit is income protection.

Without health insurance:

- Salary stops

- Medical bills continue

- EMIs remain

- School fees remain

With health insurance:

- Hospital bills = covered

- Savings = safe

- Lifestyle = protected

👉 In simple words:

Health insurance protects both money and dignity.

⏰ Why Buying Health Insurance Early Is a Smart Decision

Benefits of buying early:

| Benefit | Advantage |

|---|---|

| Lower premium | Young age = low risk |

| Waiting period | Completed early |

| No claim history | Better renewals |

| Lifelong coverage | Easy renewals later |

If you wait till 40–45:

- Premium doubles

- Diseases get excluded

- Medical tests required

👉 Best age to buy: 25–35 years

⚠️ What Happens If You Don’t Buy Health Insurance?

This is harsh, but real.

❌ Consequences:

- Forced to choose cheaper treatment

- Delay in hospital admission

- Selling investments in loss

- Taking high-interest personal loans

- Emotional stress for family

Many families regret saying:

“We should have bought health insurance earlier.”

🧾 Health Insurance = Tax Saving + Protection (Double Benefit)

Under Section 80D, you save tax while protecting your family.

| Coverage | Tax Benefit |

|---|---|

| Self + family | ₹25,000 |

| Parents (senior citizens) | ₹50,000 |

| Total possible saving | ₹75,000 |

👉 You are rewarded by the government for being financially responsible.

🧠 Why Health Insurance Is a “Must-Have” Product Today

Health insurance is no longer optional because:

✔ Healthcare is expensive

✔ Lifestyle diseases are rising

✔ Stress & pollution are increasing

✔ Private hospitals dominate

✔ Savings are limited

✔ Medical emergencies are unpredictable

👉 That’s why health insurance is now as important as food, rent, and education.

📌 Final Thought for MaintainMarket Readers

“Health insurance doesn’t make you rich,

but it prevents you from becoming poor.”

If you truly care about:

- Your family’s safety

- Your financial future

- Your peace of mind

Then buying the right family health insurance today is one of the smartest decisions you’ll ever make.

FAQs – Best Health Insurance in India for Family

Q1. Which is the best health insurance in India for family?

HDFC ERGO Optima Secure and Niva Bupa ReAssure are among the best due to high coverage and strong claim settlement.

Q2. Is family floater better than individual health insurance?

Yes, for young families. Individual plans are better for senior citizens.

Q3. How much does family health insurance cost in India?

₹10,000–₹18,000 per year for ₹10 lakh cover (young family).

Q4. Can parents be included in family health insurance?

Yes, but it is not recommended. Buy a separate policy for parents.

Q5. Which health insurance has no room rent limit?

HDFC ERGO Optima Secure, Niva Bupa ReAssure.

Q6. Is health insurance tax deductible?

Yes, under Section 80D up to ₹75,000.

Final Verdict: Which Family Health Insurance Should You Buy?

| Situation | Best Choice |

|---|---|

| Metro city family | HDFC ERGO Optima Secure |

| Budget buyers | Care Supreme |

| Parents included | Star Health |

| Unlimited recharge | Niva Bupa ReAssure |

| Salaried professionals | ICICI Lombard |

💡 MaintainMarket Pro Tip

If you want peace of mind + inflation protection, choose:

👉 ₹15–20 lakh cover with recharge benefit

Also Read: Best Bike Insurance Companies

Also Read: Top 10 SIP Plans in India

One Comment