Best Car Insurance for Low Credit Score (2026 Guide)

Image Credit: ChatGPT

Introduction: Can You Get Car Insurance with a Low Credit Score?

If you have a low credit score, getting affordable car insurance may feel impossible—but the truth is, you still have options.

In countries like the United States, insurance companies often use a credit-based insurance score to help determine premiums. A lower score doesn’t mean rejection—but it can mean higher rates unless you choose the right insurer.

This guide will help you understand:

- Why credit scores affect car insurance

- The best car insurance companies for low credit scores

- How much more you might pay (real cost examples)

- Smart ways to lower your premium even with bad credit

Why Do Insurance Companies Check Credit Scores?

Insurance providers believe that drivers with lower credit scores may:

- File more claims

- Miss premium payments

- Be statistically riskier (based on internal data models)

❗ Important: Insurance companies do not check your CIBIL score like banks do. They use a credit-based insurance score, which is different.

Average Cost of Car Insurance with Low Credit Score

| Credit Score Range | Avg Annual Premium (USA) |

|---|---|

| Excellent (750+) | $1,200 – $1,500 |

| Average (650–700) | $1,800 – $2,200 |

| Poor (Below 600) | $2,800 – $4,000 |

💡 A low credit score can increase premiums by 70%–100% if you choose the wrong insurer.

✅ Best Car Insurance Companies for Low Credit Score

1️⃣ GEICO

Why GEICO is good for low credit drivers:

- Competitive pricing even with poor credit

- Strong digital discounts

- Fast online quotes

Best For: Budget-focused drivers who want instant coverage

Downside: Fewer personalized agent services

2️⃣ State Farm

Why State Farm works well:

- Credit score has less impact compared to others

- Discounts for safe driving & bundled policies

Best For: Long-term policyholders and families

Downside: Slightly higher base premiums

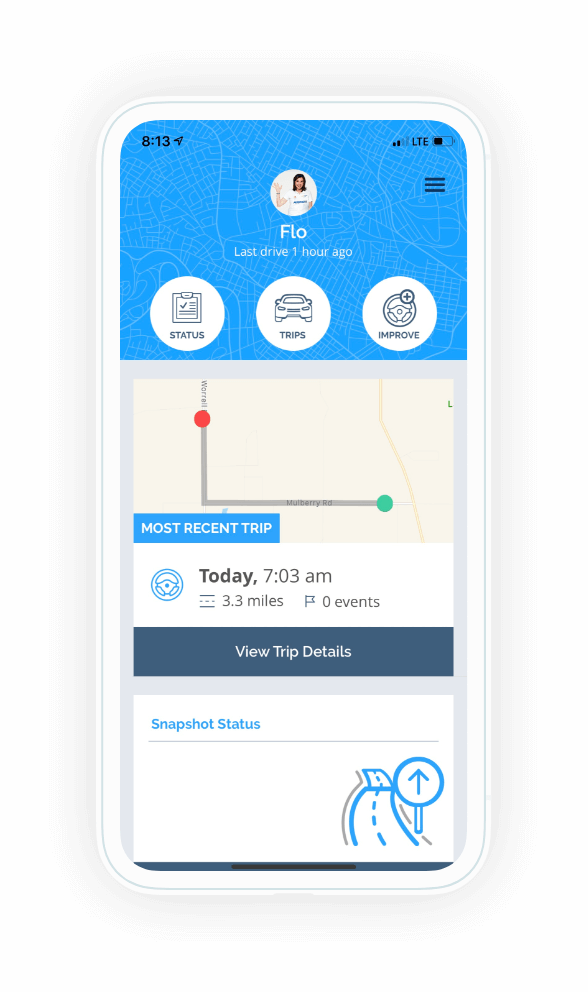

3️⃣ Progressive

Key Advantage:

- Snapshot® telematics can reduce rates regardless of credit

- Flexible payment plans

Best For: Drivers willing to prove safe driving habits

Downside: Rates may rise after renewal if driving behavior worsens

4️⃣ Allstate

Why choose Allstate:

- Usage-based discounts through Drivewise

- Strong claim settlement network

Best For: Drivers with improving credit scores

Downside: Higher initial premiums

5️⃣ The General

Why it’s unique:

- Accepts very low credit & high-risk drivers

- No long credit history required

Best For: Rejected drivers elsewhere

Downside: Limited coverage options

💸 Real Cost Example (Low Credit Driver)

Profile:

- Age: 29

- Credit Score: 560

- Location: Texas

- Vehicle: 2018 Honda Civic

| Insurance Company | Annual Premium |

|---|---|

| GEICO | $2,350 |

| Progressive | $2,180 |

| State Farm | $2,420 |

| The General | $3,100 |

👉 Progressive saved $920/year due to telematics discount.

🚘 Best Car Insurance Options by Situation

✔ If Your Credit Score Is Below 600

👉 Progressive, The General

✔ If You Want Lowest Monthly Payment

👉 GEICO, Progressive

✔ If You Are Improving Credit

👉 State Farm, Allstate

✔ If You Have Past Missed Payments

👉 The General

🔥 How to Lower Car Insurance with Bad Credit

1️⃣ Choose Usage-Based Insurance

Telematics apps track actual driving, not credit.

2️⃣ Pay Premium in Full

Avoid monthly EMI charges (saves 8–12%).

3️⃣ Increase Deductible

Higher deductible = lower premium.

4️⃣ Bundle Policies

Auto + renters/home insurance = up to 25% discount.

5️⃣ Improve Credit Slowly

Even moving from 550 → 620 can reduce premium significantly.

How Credit Score Is Calculated for Car Insurance (Insurance Score Explained)

Many people assume insurers use the same FICO score that banks use—but that’s not true.

What Insurers Actually Check

Insurance companies calculate a credit-based insurance score, which focuses on:

- Payment history (most important)

- Outstanding debt

- Length of credit history

- Credit mix (cards, loans, etc.)

- Recent credit inquiries

❗ Important Difference

- Late payments affect insurance score more heavily

- Income level is not considered

- Employment status is not checked

This is why someone earning $100,000 can still pay high insurance premiums.

📉 How Much Extra Do You Pay with a Low Credit Score? (Detailed Breakdown)

Here’s a realistic premium difference example:

Same Driver, Same Car, Same City

- Location: Florida

- Car: 2020 Toyota Corolla

- Age: 32

- Clean driving record

| Credit Level | Monthly Premium | Annual Cost |

|---|---|---|

| Excellent (760+) | $110 | $1,320 |

| Fair (650) | $165 | $1,980 |

| Poor (580) | $265 | $3,180 |

💥 Difference: $1,860 extra per year just due to credit score.

This is exactly why choosing the right insurer matters.

🏆 Best Coverage Types for Drivers with Low Credit Score

Choosing the wrong coverage can destroy your budget. Here’s what works best:

✅ Liability-Only Coverage

Best if:

- Your car value is low

- Car is older than 7–8 years

💰 Cheapest option for bad credit drivers

✅ Full Coverage (Selective)

Best if:

- Car is financed

- You drive daily

- Repair cost is high

💡 Tip: Increase deductible to reduce monthly premium.

❌ Add-ons to Avoid Initially

- Roadside assistance (can be bought cheaper separately)

- Rental reimbursement

- Zero deductible add-ons

🚦 Best Car Insurance If You Have No Credit History

No credit ≠ bad credit.

If you’re:

- A student

- New immigrant

- First-time credit user

You are actually less risky than bad-credit drivers.

Best Options for No Credit

- Progressive (telematics-based)

- GEICO (thin file friendly)

- State Farm (relationship-based)

👉 Telematics + on-time payments can give you fast discounts.

📱 Telematics Programs That Ignore Credit Score

Telematics programs reward how you drive, not your credit.

Best Programs:

- Progressive Snapshot

- Allstate Drivewise

- State Farm Drive Safe & Save

Tracked Behaviors:

- Braking

- Speed

- Mileage

- Time of driving

💡 Safe driving can reduce premiums by 20–40%, even with bad credit.

🧾 Monthly Payment Plans for Low Credit Drivers

If annual payment is difficult, choose insurers with flexible billing:

Best Monthly Options:

- Progressive – low down payment

- The General – custom payment dates

- GEICO – auto-pay discounts

❗ Avoid missing payments—policy lapse can increase premium by 30–50% next time.

🌎 States Where Credit Score Has Less Impact

Good news—location matters a lot.

States Restricting Credit-Based Pricing:

- California

- Hawaii

- Massachusetts

- Michigan

If you live in these states, your driving record matters more than credit.

⚠️ What Happens If You Let Insurance Lapse?

This is a silent killer for low-credit drivers.

Consequences:

- Treated as high-risk driver

- Premium increases by 25–60%

- Limited insurer choices

- May require SR-22 filing in some states

💡 Even minimum liability coverage is better than no insurance.

📈 90-Day Strategy to Reduce Premium with Bad Credit

Month 1

- Buy telematics-based insurance

- Pay on time

- Drive safely

Month 2

- Improve credit utilization (below 30%)

- Avoid new credit applications

Month 3

- Ask insurer for re-rating

- Compare quotes again

👉 Many drivers save $500–$1,200/year after 3–6 months.

✅ Final Power Advice

Low credit does not mean lifetime penalty.

Smart insurer + safe driving + patience = massive savings

If you want, next I can:

- Expand this into cluster articles

- Create comparison landing pages

- Optimize for Google Discover

- Add USA lead-gen CTA copy

❌ Common Mistakes to Avoid

- ❌ Choosing insurer without comparison

- ❌ Ignoring telematics programs

- ❌ Lying on application (can void claims)

- ❌ Letting policy lapse (huge red flag)

❓ Frequently Asked Questions (FAQs)

Q1. Is car insurance denied for low credit score?

No. Insurance companies cannot legally deny coverage, but they may charge higher premiums.

Q2. What credit score is considered bad for car insurance?

Generally, anything below 600 is considered poor.

Q3. Which state doesn’t allow credit-based pricing?

California, Hawaii, Massachusetts, and Michigan restrict or ban credit-based insurance pricing.

Q4. Can improving credit reduce premium?

Yes. Many insurers re-check credit score at renewal.

Q5. Is no-credit insurance possible?

Yes. Companies like The General and Progressive offer options without deep credit history checks.

Q6. Does checking insurance quote hurt credit score?

No. Insurance inquiries are soft checks.

Q7. Can insurers cancel policy due to credit?

No, but they can increase premium at renewal.

Q8. Is prepaid insurance cheaper?

Yes. Paying 6-12 months upfront saves money.

Q9. Does marital status affect insurance score?

Indirectly. Married drivers statistically get lower rates.

3 Comments