Here in this article, we are going to guide you on mortgage refinance rates.

Mortgage refinance rates today play a crucial role in determining whether refinancing your home loan will actually save you money or end up costing more in the long run. With interest rates constantly changing due to inflation, Federal Reserve policies, and global economic conditions, homeowners often wonder: Is now a good time to refinance my mortgage?

In this in-depth guide, we’ll explain current mortgage refinance rates, how they work, what affects them, who should refinance now, and how you can lock the lowest possible refinance rate today.

📌 What Are Mortgage Refinance Rates?

Mortgage refinance rates are the interest rates lenders charge when you replace your existing home loan with a new one. Refinancing allows homeowners to:

- Lower their interest rate

- Reduce monthly mortgage payments

- Change loan term (30-year → 15-year)

- Switch from adjustable to fixed rate

- Take cash out from home equity

The refinance rate you receive directly impacts your monthly payment and total interest paid over the life of the loan.

📊 Mortgage Refinance Rates Today (National Averages)

As of today, mortgage refinance rates in the U.S. are hovering around:

| Loan Type | Average Refinance Rate |

|---|---|

| 30-Year Fixed Refinance | ~6.0% – 6.5% |

| 15-Year Fixed Refinance | ~5.2% – 5.8% |

| 5/1 ARM Refinance | ~6.0% – 6.4% |

| FHA Refinance | ~5.5% – 6.2% |

| VA Refinance | ~5.3% – 6.0% |

👉 Important: These are national averages. Your actual refinance rate depends on credit score, income, equity, and lender pricing.

📉 Why Mortgage Refinance Rates Change Daily

Mortgage refinance rates are not fixed — they can change daily or even hourly. The main drivers include:

🔹 1. Federal Reserve Policy

While the Fed doesn’t set mortgage rates directly, its interest-rate decisions influence bond markets, which mortgage rates follow.

🔹 2. 10-Year Treasury Yield

Mortgage rates closely track the 10-year U.S. Treasury bond. When yields rise, refinance rates usually increase.

🔹 3. Inflation Data

High inflation pushes rates higher; cooling inflation can lead to lower refinance rates.

🔹 4. Housing Market Demand

More refinance demand can slightly push rates up due to lender capacity limits.

🧠 Factors That Determine Your Refinance Rate

Not everyone qualifies for the same refinance rate. Lenders calculate your rate using multiple personal factors:

✔ Credit Score

- 760+ → best rates

- 700–759 → competitive rates

- Below 680 → higher refinance rates

✔ Loan-to-Value Ratio (LTV)

Lower LTV (more equity) = lower risk = better rates.

✔ Debt-to-Income Ratio (DTI)

DTI below 36% improves refinance approval and pricing.

✔ Loan Term

15-year refinance rates are usually lower than 30-year rates.

🏠 Types of Mortgage Refinance Options (Explained in Detail)

🔹 Rate-and-Term Refinance

The most common refinance option.

Best for:

✔ Lowering interest rate

✔ Reducing monthly payments

✔ Changing loan duration

No cash is taken out — only the loan terms change.

🔹 Cash-Out Refinance

You refinance for more than you owe and receive the difference in cash.

Used for:

- Home renovation

- Debt consolidation

- Education expenses

⚠️ Cash-out refinance rates are usually slightly higher.

🔹 FHA Streamline Refinance

Designed for existing FHA loan holders.

✔ Minimal documentation

✔ No appraisal (in some cases)

✔ Faster approval

🔹 VA IRRRL Refinance

Available for veterans with VA loans.

✔ Very low closing costs

✔ No appraisal in many cases

✔ Competitive refinance rates

💸 Real Example: How Much Can You Save by Refinancing?

Scenario:

- Current loan: $300,000 at 7.25%

- New refinance rate: 6.00%

- Term: 30 years

Savings:

- Monthly payment reduction: ~$240

- Annual savings: ~$2,880

- Long-term interest savings: $80,000+

👉 Even a 1% drop in refinance rate can mean massive savings.

⏰ Is Now a Good Time to Refinance?

You should consider refinancing today if:

✔ Your current mortgage rate is 1% or more higher

✔ You plan to stay in the home for 3+ years

✔ You want predictable monthly payments

✔ You want to eliminate PMI

You should wait if:

❌ Closing costs outweigh savings

❌ You plan to sell soon

❌ Credit score is temporarily low

📈 Mortgage Refinance Trends in 2026

Current refinance market trends show:

- Refinance applications rising gradually

- Lenders offering more flexible programs

- Adjustable-rate refinances gaining attention

- Cash-out refinancing slowing due to rate sensitivity

Experts expect moderate rate fluctuations, not drastic drops.

🏦 How to Get the Best Mortgage Refinance Rate Today

✅ 1. Improve Credit Score Before Applying

Pay down credit cards and avoid new credit inquiries.

✅ 2. Compare Multiple Lenders

Never accept the first offer. Compare at least 3–5 lenders.

✅ 3. Consider Paying Discount Points

Paying upfront fees can reduce your interest rate long-term.

✅ 4. Lock Your Rate at the Right Time

Rate locks protect you from sudden market increases.

📋 Hidden Costs of Refinancing (Don’t Ignore)

Refinancing isn’t free. Typical costs include:

- Origination fee

- Appraisal fee

- Title insurance

- Recording fees

- Prepaid taxes & insurance

Total closing costs usually range between 2%–6% of loan amount.

📊 Mortgage Refinance Rates vs Home Loan Rates

| Factor | Refinance | New Mortgage |

|---|---|---|

| Interest Rate | Slightly higher | Lower |

| Documentation | Similar | Similar |

| Closing Costs | Yes | Yes |

| Approval Time | Faster | Standard |

🧮 Break-Even Point: The Most Important Calculation

Break-even point =

Closing costs ÷ Monthly savings

If closing costs are $5,000 and you save $250/month →

Break-even = 20 months

👉 Stay longer than that? Refinancing makes sense.

❌ Common Refinance Mistakes to Avoid

- Refinancing too frequently

- Extending loan term unnecessarily

- Ignoring APR (not just interest rate)

- Taking cash-out without a plan

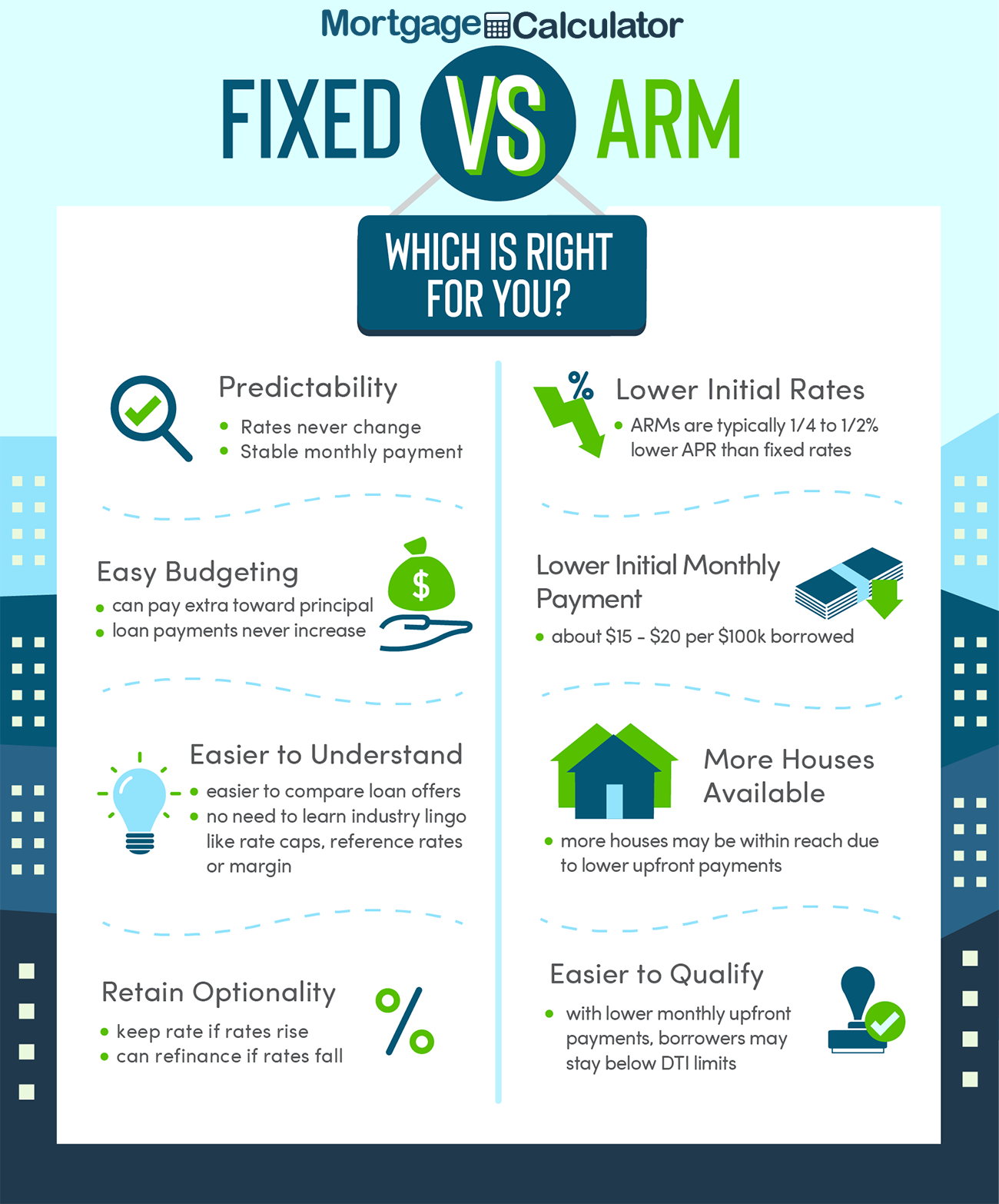

🔐 Fixed vs Adjustable Refinance: Which Is Better?

Fixed-Rate Refinance

✔ Stable payments

✔ Long-term security

Adjustable-Rate Refinance

✔ Lower initial rate

❌ Risk of future increases

Best choice depends on how long you plan to stay in the home.

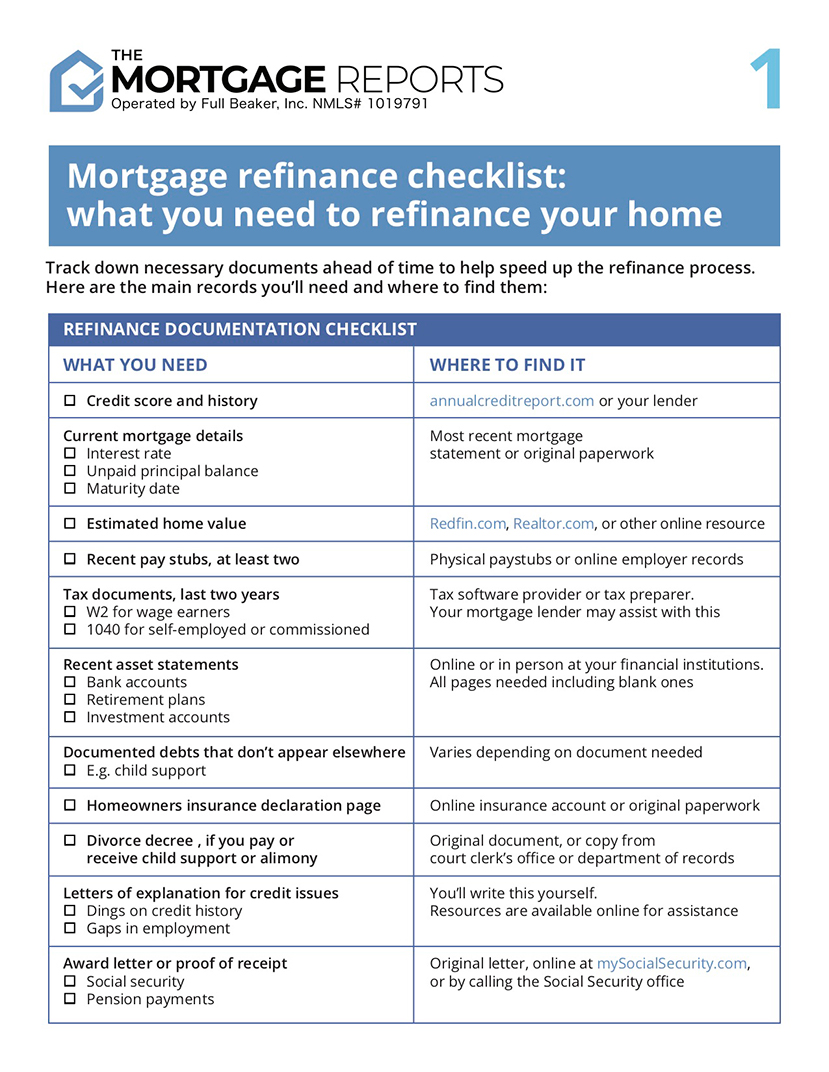

🧾 Mortgage Refinance Checklist

Before applying, prepare:

- Credit report

- Income proof

- Tax returns

- Property insurance

- Current mortgage statement

Being prepared speeds up approval and improves offers.

Mortgage Refinance Rates Today by State (Why Location Matters)

Mortgage refinance rates are not the same across the U.S.

Lenders adjust rates based on state regulations, housing demand, and risk profiles.

States With Typically LOWER Refinance Rates

- Texas

- Florida

- North Carolina

- Arizona

Reason:

✔ High lender competition

✔ Strong housing demand

✔ Favorable lending laws

States With Slightly HIGHER Refinance Rates

- New York

- New Jersey

- California

- Massachusetts

Reason:

❌ Higher property values

❌ Tighter regulations

❌ Higher closing costs

👉 Always compare local lenders + national lenders.

🧮 Refinance Rates Based on Credit Score (Very Important)

Your credit score alone can change your refinance rate by 1%–1.5%.

| Credit Score | Typical Refinance Rate Impact |

|---|---|

| 760+ | Lowest rates available |

| 720–759 | Slightly higher |

| 680–719 | Moderate increase |

| 620–679 | High rates |

| Below 620 | Limited refinance options |

💡 Improving your score even by 20–30 points before refinancing can save thousands.

📉 How Inflation Impacts Mortgage Refinance Rates

Inflation is one of the biggest enemies of low refinance rates.

When inflation:

- Rises → refinance rates go up

- Falls → refinance rates stabilize or decline

This is why refinance rates react strongly to:

- CPI reports

- Jobs data

- Federal Reserve statements

👉 Smart homeowners watch economic calendars before locking rates.

🏦 Banks vs Online Lenders: Who Offers Better Refinance Rates?

Traditional Banks

✔ Brand trust

❌ Slower approval

❌ Higher fees

Online Mortgage Lenders

✔ Lower refinance rates

✔ Faster processing

✔ More flexible credit criteria

Credit Unions

✔ Lower fees

✔ Personalized service

❌ Membership required

💡 Best strategy: Get quotes from all three.

📌 Mortgage Refinance Rates Today for Investment Properties

Refinancing an investment property is different from a primary home.

What Changes:

- Rates are 0.5%–1% higher

- Higher equity required (25%+)

- Stricter income verification

Still, refinancing can:

✔ Improve cash flow

✔ Reduce long-term interest

✔ Fund new property purchases

🏘️ Mortgage Refinance Rates for Condos & Multi-Family Homes

Lenders see condos and multi-family homes as slightly higher risk.

- Condo refinance rates: +0.125%–0.25%

- Multi-family refinance rates: +0.25%–0.50%

💡 FHA and VA refinances are often more favorable here.

🔁 Mortgage Refinance vs Loan Modification (Know the Difference)

Many homeowners confuse these two.

Refinance

✔ New loan

✔ New interest rate

✔ Closing costs apply

Loan Modification

✔ Same loan

✔ Changed terms

✔ Usually for financial hardship

👉 Refinancing is for saving money.

👉 Modification is for avoiding default.

⏳ Best Time of Month to Lock Refinance Rates

Believe it or not, timing matters.

✔ Middle of the week (Tue–Thu)

✔ After inflation reports (if favorable)

✔ Avoid major Fed announcement days

No guarantee — but timing can help slightly.

🔐 Rate Lock vs Float: What Should You Choose?

Rate Lock

✔ Protection from increases

✔ Peace of mind

Float

✔ Chance to get lower rate

❌ Risky in volatile markets

💡 If refinance rates drop suddenly, some lenders offer float-down options.

📊 Refinance Rates vs Home Equity Loans (Comparison)

| Feature | Refinance | Home Equity Loan |

|---|---|---|

| Interest Rate | Lower | Higher |

| Closing Costs | Higher | Lower |

| Monthly Payment | Single | Separate |

| Best For | Long-term savings | Short-term cash |

🚨 Warning Signs of a Bad Refinance Deal

Avoid lenders who:

❌ Push urgency

❌ Hide APR

❌ Don’t provide loan estimate

❌ Promise “guaranteed lowest rate”

Always ask for:

✔ Loan Estimate (LE)

✔ Closing Disclosure (CD)

🧠 Psychological Mistake Homeowners Make

Many homeowners refinance only for lower monthly payments.

But sometimes:

- Shorter term = higher payment, much lower interest

- Cash-out = comfort today, risk tomorrow

👉 Always look at total interest paid, not just EMI.

📈 Long-Term Impact of Refinancing Multiple Times

Refinancing multiple times can:

✔ Help adapt to life changes

❌ Increase total loan cost if misused

Rule of thumb:

👉 Don’t refinance again unless:

- Rate drops at least 0.75%

- You recover closing costs within 24 months

🏁 Conclusion: Mortgage Refinance Rates Today

Mortgage refinance rates today still present real opportunities — but only for homeowners who understand the numbers, timing, and long-term impact.

Refinancing is not just about chasing the lowest rate. It’s about:

- Matching loan terms to life goals

- Managing risk

- Building long-term wealth

A smart refinance can:

✔ Save thousands

✔ Improve cash flow

✔ Increase financial security

A rushed refinance can:

❌ Increase debt

❌ Extend loan unnecessarily

👉 Knowledge is the difference.

❓ Frequently Asked Questions (FAQs)

Q1. What are mortgage refinance rates today?

Currently, 30-year fixed refinance rates average around 6%–6.5%, depending on borrower profile.

Q2. Will refinance rates go down soon?

Rates may fluctuate but predicting exact drops is difficult.

Q3. Does refinancing hurt credit score?

Yes, but rates will be higher and options limited.

Q4. How often can i refinance?

There’s no legal limit, but frequent refinancing may not be cost-effective.

🏁 Final Verdict: Mortgage Refinance Rates Today

Mortgage refinance rates today remain reasonable by historical standards, offering homeowners opportunities to reduce costs, stabilize payments, or access equity — if refinancing is done strategically.

The key is:

- Compare lenders

- Calculate break-even

- Understand total costs

- Choose the right refinance type

👉 A well-timed refinance can save tens of thousands of dollars over time.

Also read: Personal Loan for Bad Credit USA

Also read: Best Car for Low Credit Score

1 thought on “Mortgage Refinance Rates Today (2026) – Latest Rates & Best Refinance Options”