Personal Loan for Bad Credit USA (2026 Complete Guide)

You are in the right place if you are looking for “Personal loan for Bad Credit USA”. Read more…

Introduction: Can You Get a Personal Loan with Bad Credit in the USA?

Yes, you can get a personal loan in the USA even with bad credit.

Millions of Americans have credit scores below 600 due to:

- Missed payments

- Medical bills

- Job loss

- High credit utilization

The good news? Many lenders now focus on income, employment, and repayment ability, not just your credit score.

This guide explains:

- Best personal loan lenders for bad credit in the USA

- Interest rates & real cost examples

- How to improve approval chances

- Smart alternatives if you get rejected

What Is Considered “Bad Credit” in the USA?

| Credit Score | Category |

|---|---|

| 720+ | Excellent |

| 660–719 | Good |

| 600–659 | Fair |

| Below 600 | Bad / Poor Credit |

👉 Most “bad credit loans” are designed for scores between 450–600.

Average Interest Rates for Bad Credit Personal Loans

| Credit Score | APR Range |

|---|---|

| 720+ | 6% – 10% |

| 650–699 | 10% – 18% |

| 550–600 | 18% – 35% |

| Below 500 | 25% – 45% |

⚠️ Always compare APR, not just monthly EMI.

✅ Best Personal Loan Lenders for Bad Credit in the USA

1️⃣ Upstart

Why Upstart is great:

- Accepts credit scores as low as 300

- Uses AI + income + education

- Fast approval (1 business day)

Loan Amount: $1,000 – $50,000

APR: 8% – 35%

Best For: Young professionals, thin credit files

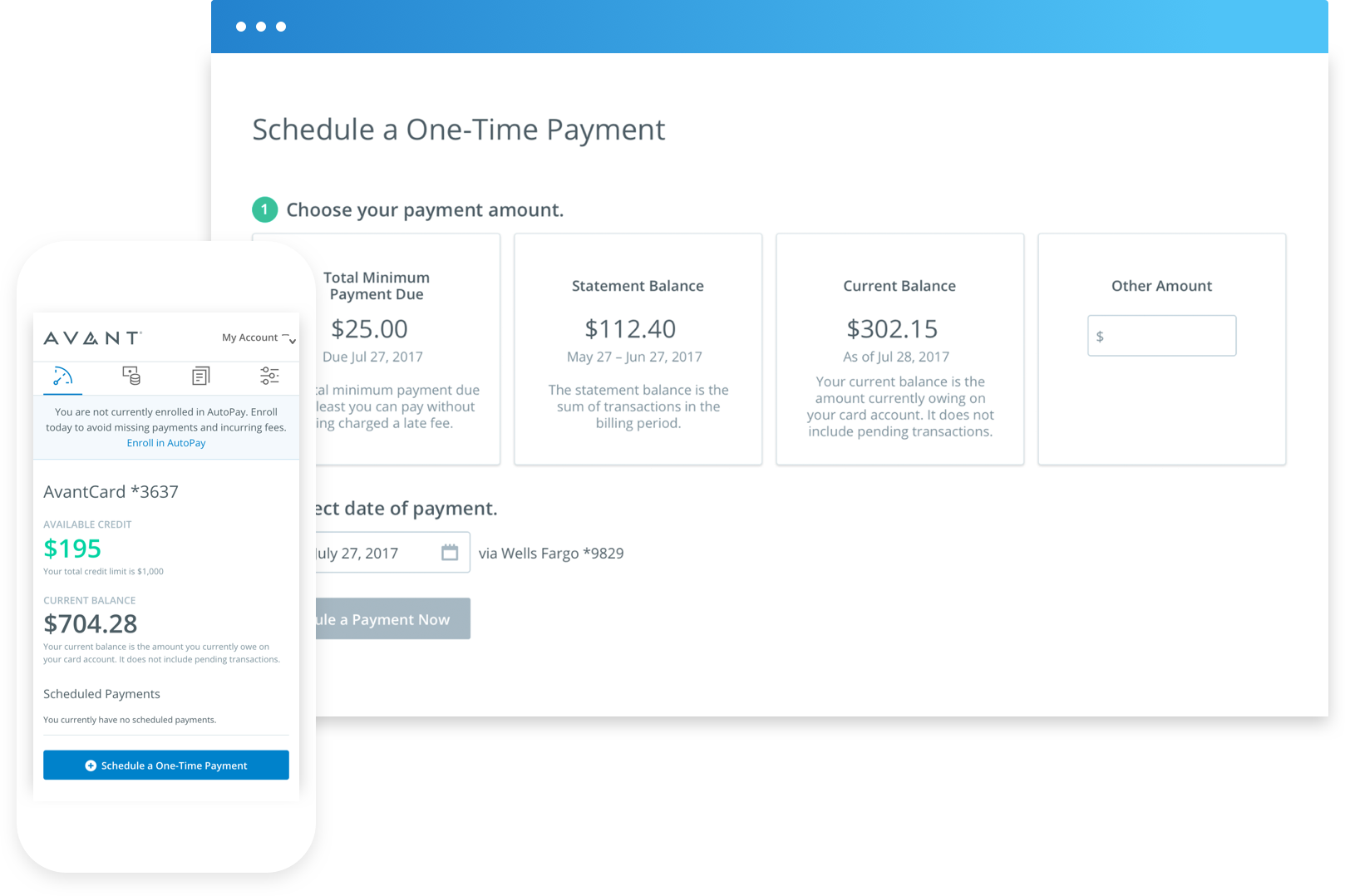

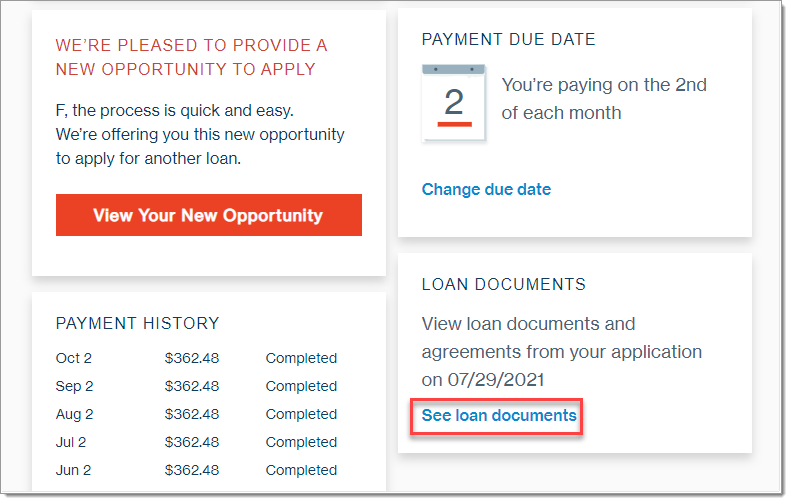

2️⃣ Avant

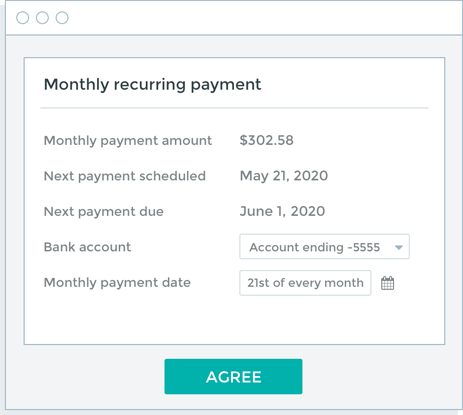

Key Benefits:

- Minimum credit score ~550

- Simple online process

- Fixed monthly payments

Loan Amount: $2,000 – $35,000

APR: 9.95% – 35.99%

Best For: Emergency expenses

3️⃣ LendingClub

Why it stands out:

- Peer-to-peer model

- Lower rates if income is stable

- Accepts fair to poor credit

Loan Amount: $1,000 – $40,000

APR: 8% – 36%

Best For: Debt consolidation

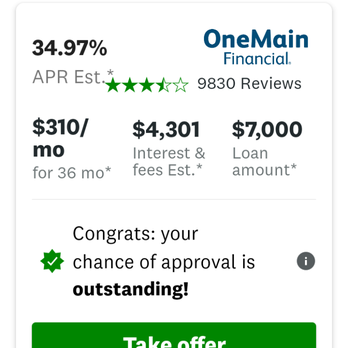

4️⃣ OneMain Financial

Why choose OneMain:

- Accepts very poor credit

- Offers secured loans

- In-person support available

Loan Amount: $1,500 – $20,000

APR: 18% – 36%

Best For: Extremely low credit scores

5️⃣ Upgrade

Best Features:

- Credit-building tools

- Lower rates with autopay

- Flexible repayment

Loan Amount: $1,000 – $50,000

APR: 8% – 36%

Best For: Improving credit over time

💸 Real Loan Cost Example (Bad Credit Borrower)

Profile

- Credit Score: 570

- Loan Amount: $5,000

- Tenure: 36 months

| Lender | APR | Monthly EMI | Total Repayment |

|---|---|---|---|

| Upstart | 22% | $191 | $6,876 |

| Avant | 29% | $210 | $7,560 |

| OneMain | 32% | $221 | $7,956 |

👉 Difference: Over $1,000 just by choosing the right lender.

🧠 Best Personal Loan Options by Situation

✔ If Credit Score Is Below 500

👉 OneMain Financial, secured loans

✔ If You Have Income but Poor Credit

👉 Upstart, LendingClub

✔ If You Want to Improve Credit

👉 Upgrade, credit-builder loans

✔ If You Need Emergency Cash

👉 Avant, Upstart

🚫 Loans to Avoid with Bad Credit

❌ Payday loans (APR up to 400%)

❌ Title loans (risk of losing vehicle)

❌ Unlicensed online lenders

💡 If APR > 36%, think twice.

📈 How to Increase Approval Chances (Very Important)

1️⃣ Show Stable Income

Even part-time income helps.

2️⃣ Reduce Debt-to-Income Ratio

Below 40% = higher approval chance.

3️⃣ Apply for Smaller Amount

Lower loan = easier approval.

4️⃣ Use Co-Signer (If Possible)

Instant rate reduction.

5️⃣ Avoid Multiple Applications

Too many checks hurt approval odds.

🔄 Alternatives If You’re Rejected

- Credit union loans

- Secured personal loans

- Employer paycheck advances

- Credit-builder loans

🏦 Bank vs Online Lenders: Which Is Better for Bad Credit?

When you have bad credit, where you apply matters as much as how you apply.

Traditional Banks (Chase, Wells Fargo, Bank of America)

❌ Very strict credit requirements

❌ Rarely approve scores below 620

❌ Long approval timelines

👉 Not recommended for bad credit borrowers

Online Lenders (Best Choice)

✔ Flexible underwriting

✔ Income-based approvals

✔ Faster funding (24–48 hours)

👉 This is why platforms like Upstart, Avant, Upgrade dominate bad-credit lending.

Credit Unions (Hidden Gem)

✔ Lower interest rates

✔ Member-focused

✔ More lenient with past mistakes

💡 If you qualify, credit unions often beat banks.

🧾 Secured vs Unsecured Personal Loans (Very Important Section)

🔓 Unsecured Personal Loans

- No collateral required

- Higher APR

- Approval depends on income + credit

Best for: Moderate bad credit (550–600)

🔒 Secured Personal Loans

- Requires collateral (car, savings, asset)

- Much lower interest rate

- Higher approval chances

Best for: Very poor credit (below 500)

⚠️ Risk: If you miss payments, you may lose the asset.

📉 Debt Consolidation Loans for Bad Credit (High Search Intent)

Many people with bad credit are stuck due to multiple debts.

How Debt Consolidation Helps

- One EMI instead of many

- Lower total interest

- Improves credit score over time

Best Lenders for Debt Consolidation (Bad Credit)

- LendingClub

- Upgrade

- Upstart

💡 Tip: Close old credit cards only after loan disbursement.

⏳ Same-Day & Emergency Personal Loans (USA)

If you need urgent cash, speed matters.

Fastest Approval Lenders

- Upstart – Same or next business day

- Avant – Fast processing

- OneMain Financial – In-branch same day (in some states)

⚠️ Emergency loans have higher APR—borrow only what you need.

📍 State-Wise Loan Availability (USA Insight)

Loan approval and APR vary by state due to regulations.

States with Better Bad-Credit Loan Access

- Texas

- Florida

- Georgia

- Arizona

States with Strict Rules

- New York

- New Jersey

- Massachusetts

💡 If your state has restrictions, expect lower loan limits.

🧮 EMI Breakdown Example (Very Practical)

Loan Details

- Amount: $8,000

- Credit Score: 560

- APR: 26%

- Tenure: 48 months

Monthly EMI: ~$252

Total Interest Paid: ~$4,096

Total Repayment: ~$12,096

👉 Choosing 36 months instead of 48 months can save $1,000+.

📊 Personal Loan vs Credit Card for Bad Credit

| Factor | Personal Loan | Credit Card |

|---|---|---|

| Interest | Fixed (18–36%) | Variable (25–45%) |

| EMI | Fixed | Minimum payment trap |

| Credit Impact | Positive if paid on time | Risky if maxed out |

| Use Case | Large expenses | Small emergencies |

✅ Personal loans are safer for structured repayment.

🚀 How This Loan Can Improve Your Credit Score (If Used Smartly)

Many people fear loans—but responsible usage helps credit.

How Score Improves:

- On-time payments (35% of score)

- Credit mix improvement

- Reduced utilization

📈 Expected improvement: 30–80 points in 6–12 months

🚨 Red Flags While Choosing a Lender

Avoid lenders who:

❌ Guarantee approval

❌ Ask for upfront fees

❌ Have no physical address

❌ Don’t disclose APR clearly

💡 Legit lenders always explain fees + APR upfront.

📌 Step-by-Step: How to Apply Safely (Beginner Friendly)

1️⃣ Check credit score (free tools)

2️⃣ CaQ1. lculate exact loan amount needed

3️⃣ Compare 3–5 lenders

4️⃣ Apply using soft check

5️⃣ Read loan agreement carefully

6️⃣ Set auto-pay immediately

❓ Frequently Asked Questions (FAQs)

What is the minimum credit score for personal loan in USA?

SOme lenders approve loans starting from 300-450, but rates are higher.

Q2. Does applying affect credit score?

Soft checks don’t. Hard checks may reduce score by 5-10 points.

Q3. Can i get loan without credit history?

Yes. Income-based like Upstart approve no-credit borrowers.

Q4. Are online loans safe?

Yes, if lender is licensed and transparent.

Q5. Can personal loans improve credit score?

Yes — if paid on time consistently.

Q6. Can I get a $10,000 loan with bad credit?

Yes, if income is stable and debt ratio is manageable

Q7. Are no-credit-check loans legit?

Most are scams. Legit lenders always do some form of check.

Q8. Does employment type matter?

Yes. Full-time employees get better rates than gig workers.

Q7. Can self-employed people get bad credit loans?

Yes, with bank statements or tax returns.

📌 Final Verdict: Best Personal Loan for Bad Credit USA

Best Overall: Upstart

Best for Very Poor Credit: OneMain Financial

Best for Credit Improvement: Upgrade

Best for Emergency Cash: Avant

👉 Always compare APR, fees, and repayment flexibility before signing.

Also read: Best Car Insurance For Low Credit Score

Also read: Best Health Insurance In India For Family

One Comment